Posted on August 31, 2022

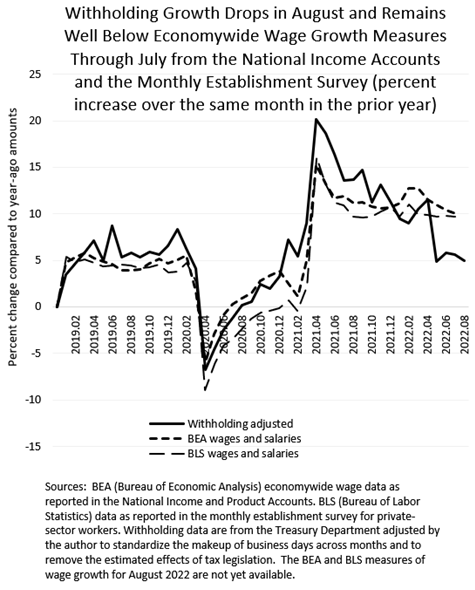

In August we observed a decline in the growth of federal tax withholding–the amount of federal income and payroll taxes withheld from workers’ paychecks and remitted to the U.S. Treasury Department. We estimate that tax withholding grew by 4.9 percent in August (compared to the amounts from August of a year ago, measuring so called year-over-year growth), a decline from the year-over-year growth of 5.7 percent in July and 5.8 percent in June (see chart below). That recent amount of withholding growth is low compared to both the 9 percent to 12 percent range that withholding grew from January to April and to recent growth in economywide wages and salaries as measured by the Bureau of Economic Analysis (BEA) in its GDP accounts and by the Bureau of Labor Statistics (BLS) in its establishment survey of private-sector workers. Note that our measure of growth of tax withholding is constructed by taking the actual withholding amounts reported daily by the Treasury Department and then both removing the estimated effects of tax law changes (currently a small adjustment) and standardizing the makeup of business days across months (see our methodology for more details).

Withholding growth tends to move with economywide wages, so the recently low growth in withholding compared to that of the direct wage measures raises questions such as whether the direct wage measures will be revised down when better data become available (with the BEA measure especially subject to revision) or whether movements in average tax rates in the economy, such as from changes in the income distribution, are causing withholding growth to deviate from wage growth. Those direct measures of wages are currently available through July, with the BLS measure for August becoming available in the monthly employment report to be released on Friday of this week. In addition, the BEA has a major historical revision to the GDP accounts scheduled for late September.