Posted on April 19, 2023

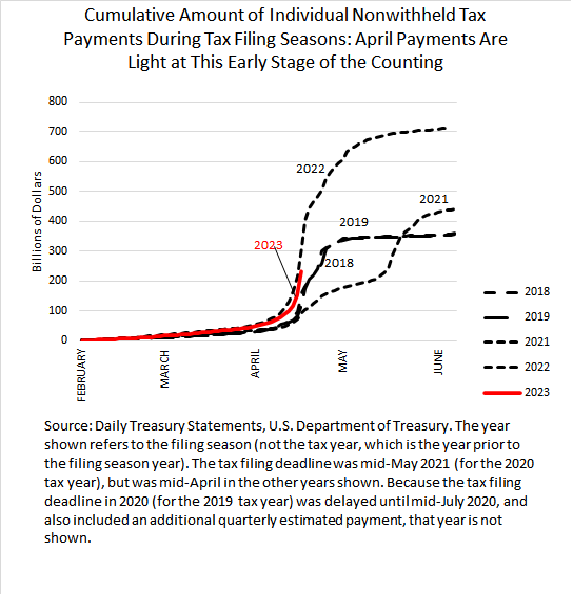

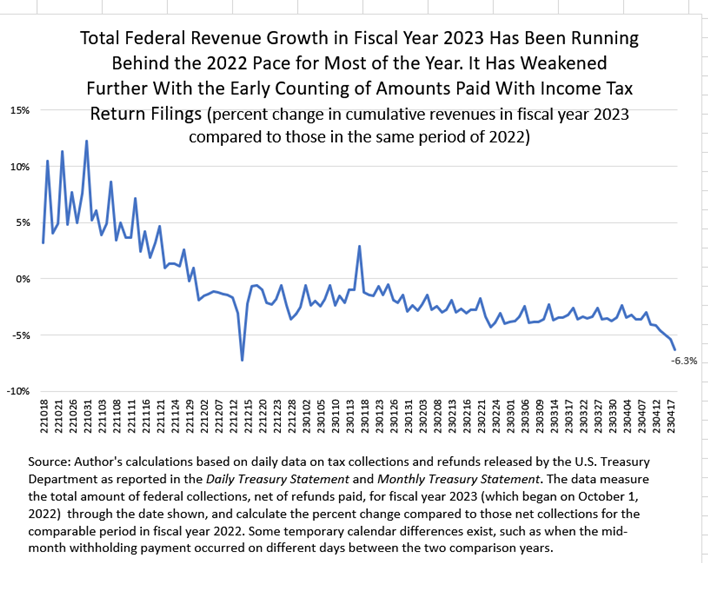

Federal tax day was yesterday. The amount of money collected and reported by the IRS from individual income tax return filings is running well behind last year’s pace at this same point in the process. We cannot draw firm conclusions because normally only about one-third to one-half of the total amount has been counted at this point in the IRS processing of returns (with the tax filing season starting back in February), and the amounts counted later in the process can vary a lot between tax seasons. Nonetheless, amounts counted to date are running about 25 percent to 30 percent below last year’s pace at this same point (see the first chart below–where it is difficult to see the decline so far this year when the lines are going nearly vertical on a very compressed scale). If that decline in payments with tax returns continued, that would put the amounts paid somewhere well between last year’s very large amount and the smaller amounts from 2018 and 2019, the most recent years before 2022 with the same mid-April tax return due date. But we cannot tell if that decline to date will continue. The weakness in payments so far does, though, noticeably weaken total federal revenue growth thus far this year (see the second chart below), and it raises the risk that the federal debt limit will become binding sometime in June, on the earliest side of the prior estimates from federal government and other sources.

Today we got information on the amount of electronic payments made yesterday, the filing due date and normally the largest electronic payment date. Additional significant amounts of electronic payments normally get counted and reported in the next couple of days. After that, it is mainly a matter of the IRS opening the mailed returns and counting the payments from the enclosed checks. That full process usually takes until early May.

The speed at which the IRS is able to count the payments with tax returns varies from year to year. If the IRS is counting the payments faster this year than last year, for example as its operations normalize more from the pandemic, then that would mean the weakness we observe in tax payments so far is understated. Alternatively, if the speed of processing is slower than normal, then the amounts paid could start to catch up to last year’s unusually high amount.

The weakness in tax payments with income tax returns counted so far has had a noticeable downward effect on our estimate of growth in total federal revenues (from all sources) for the fiscal year compared to last year at this same point. We estimate that total revenues for the fiscal year-to-date are now down by about 6.3 percent, after having been down in the 3 percent range for the past couple of months until a week or so ago (again, see the second chart below). That decline in recent days can turn around if the counting of payments with tax returns is somewhat delayed this year compared to last year. But it might not turn around. If payments with tax returns remain down in the vicinity of 25 percent to 30 percent. then total revenues will lag significantly further behind. Stay tuned.