Posted on May 1, 2023

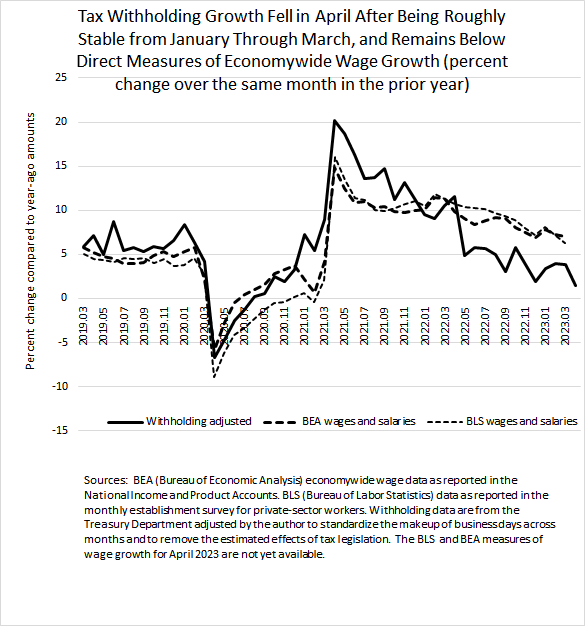

Amidst all the interest in the amounts of federal taxes paid with income tax return filings, we can’t forget about income and payroll taxes withheld from worker’s paychecks and remitted to the Treasury. We estimate that growth in withheld taxes slowed in April, measured to remove the estimated effects of tax law changes and to standardize the calendar across months. Specifically, we estimate that withholding growth was 1.4 percent in April (compared to the amounts from April of a year ago), after having been in the narrow range of 3.4 percent to 3.9 percent in each of the previous three months (see chart below). That 1.4 percent growth is not inflation-adjusted, so it would be negative growth if it were. We’ll see if that weak withholding growth portends a weaker-than-expected employment report for April to be released on Friday of this week by the Bureau of Labor Statistics. One month of weaker withholding growth could be a data anomaly. If that weak growth persists or if growth in withholding tax payments turns negative,that would suggest a significant slowing in economic activity.

For the past year, the measure of tax withholding growth has been lower than growth in wages and salaries as reported both by the Bureau of Labor Statistics (in its monthly release) and by the Bureau of Economic Analysis (in its monthly GDP release). The weaker withholding growth relative to economywide wages and salaries could stem from wage distributional shifts in which the overall wages of lower-income workers (who face lower income tax rates) have been growing relatively faster (than those of higher-income workers) after being hit especially hard during the worst of the pandemic in 2020 and into 2021. Alternatively, the wage and salary data could be revised down as additional data on those amounts for 2022 and 2023 become available.