Posted on May 5, 2023

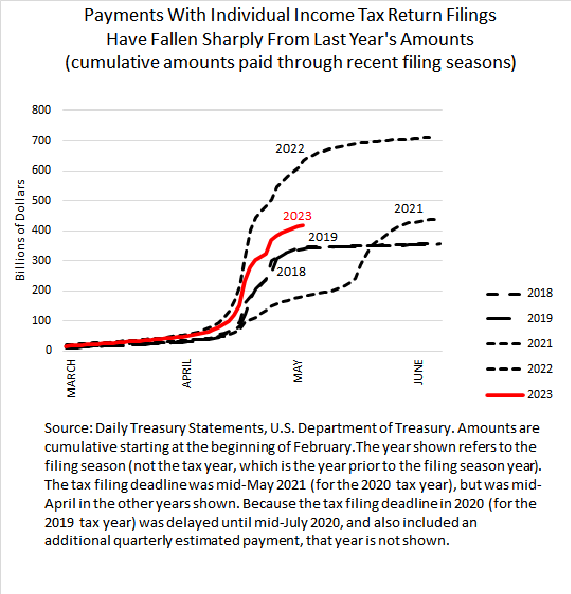

We can certainly say that tax payments with individual income tax return filings have dropped sharply this year–down by about 34 percent by our tally of the daily tax receipts through the latest amounts released for activity on May 3 (see chart below). And that percentage decline looks like it will get larger with the final counting in May. Last year the IRS counted a significant amount of such payments in May, when the agency was dealing with significant operational difficulties surrounding the pandemic. This year, the IRS has apparently been processing the amounts paid much quicker, at more like a pre-pandemic pace, as evidenced by the daily-reported amounts dropping off significantly in recent days unlike at the same time last year. It would not be surprising if, by the end of May, such payments were down by around 37 percent or more, perhaps up to 40 percent. That would put them not far above the amounts paid in 2021–though comparisons to that year are made more difficult by the one-month delay granted in the filing deadline to mid-May 2021.

One factor that could slow the payment decline in May, but probably not by much, is the payment of amounts that were delayed by extensions provided this year to taxpayers in parts of the country affected by disaster situations in recent months. Taxpayers in major parts of California, and in parts of New York, Florida, Tennessee, and other states were granted such relief. Historically, payments that were delayed for such reasons did not significantly increase the total amounts paid, but more of the country is affected this time than usual. The allowed delays are as late as mid-October of this year, such as in California, and as early as mid-May.

Although the specific income sources that are generating the big drop-off in revenues are as yet unknown, we assume that the stock market is playing a major role. The big run-up in the stock market in 2021 generated a very large increase in capital gains on stock sales by taxpayers, which together with strength in associated business income and pension distributions greatly boosted tax payments with tax returns in 2022. The drop in the stock market in 2022 presumably had the opposite effect on tax payments in 2023 that we are now observing.

Clearly the big and unexpected drop-off in revenues has analysts updating their estimates of when the federal debt limit will become binding if policymakers do not raise or suspend the limit. On Monday of this week the Treasury Department said it could occur as early as June 1, and their best estimate is sometime by early June. I don’t have a model of the daily cash flows in and out of the federal government, along with the use of extraordinary measures being employed to delay the date when the debt limit will bind. I expect we will be hearing more in coming days from analysts who do have such models, with their bracketing of the likely range of dates. There will still be uncertainty on both the spending and revenue sides. Apart from the normal daily amounts of tax withholding, the next big slug of federal revenues occurs on June 15, the due date for the next quarterly estimated payment of income taxes by individuals and most corporations. That federal revenue inflow would probably delay the debt limit binding date by weeks, but getting to that date is looking less and less likely.