Posted on July 3, 2023

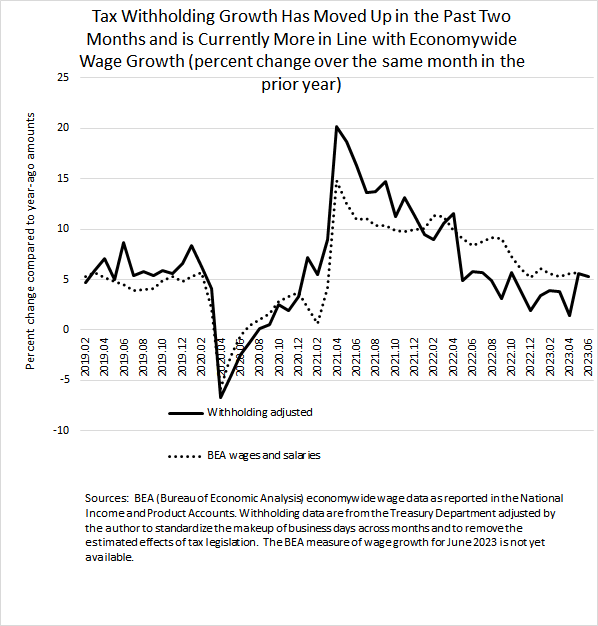

We estimate that federal tax withholding–the amount of income and payroll taxes withheld from employees’ paychecks and remitted daily to the U.S. Treasury–grew by 5.3 percent in June (compared to the amounts from June of a year ago). That is about the same as the 5.6 percent growth in May, and again near the top of the range of 2 percent to 6 percent growth recorded since May of a year ago (see the chart below). Tax withholding tends to move with overall wages and salaries in the economy, and two consecutive months of higher growth in withholding gives us some confidence that the move up in May was not an anomaly. Our measure adjusts the actual amount of tax withholding to remove the estimated effects of tax law changes (with no such adjustments needed this year) and to standardize the calendar across months. Nonetheless, other factors independent of wages and salaries can also affect tax withholding.

Tax withholding growth is now running at a similar pace to that of economywide wages and salaries as measured by the Bureau of Economic Analysis (BEA) in its monthly GDP accounts (again, see the chart below). For most of the past year, withholding growth has been well below that of economywide wages and salaries, but a downward revision to recent wage growth a couple of months ago plus the move up in withholding growth has closed the gap. We also expect that wage growth for 2022 will be revised down further–by between 0.5 and 1.0 percentage points–when BEA implements its annual revisions in late September. Our expectation for a downward revision is based on our reading of the underlying data from the Quarterly Census of Employment and Wages, for which the data for the fourth quarter of 2022 was released last month. If that downward revision to wages and salaries does occur, that would narrow the difference between economywide wage and withholding growth that we observed for most of 2022.