Posted on August 2, 2023

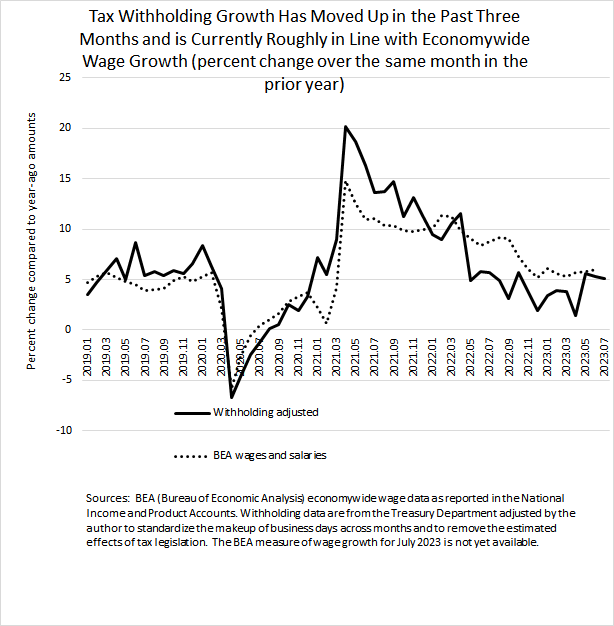

We estimate that federal tax withholding–the amount of income and payroll taxes withheld from employees’ paychecks and remitted daily to the U.S. Treasury–grew by 5.1 percent in July (compared to the amounts from July of a year ago). That is very close to the growth of 5.3 percent recorded in June and 5.6 percent in May, and was again at the higher end of the range of 2 percent to 6 percent growth recorded since May of a year ago (see chart below). Our measure adjusts the actual amount of withholding to remove the estimated effects of tax law changes (with no such adjustments needed this year) and to standardize the calendar across months.

Tax withholding tends to move with overall wages and salaries in the economy, but the tax data are available more quickly. Tax withholding in the past three months has been running at a similar pace to that of economywide wages and salaries as measured by the Bureau of Economic Analysis (BEA) in its monthly GDP account data currently available through June. For about a year, until May of this year, tax withholding had been growing more slowly than the economywide wage measure (again see the chart below). We expect that the BEA wage measure for 2022 will be revised downward in the annual revisions that will be released in late September of this year. We expect the revision to close a part of the currently-measured gap between economywide wage and withholding growth–about 0.5 to 1.0 percentage points–leaving a remaining gap on the order of a couple of percentage points. We believe that some of that remaining gap reflects shifts in the distribution of income, in which lower-wage workers (who generally face lower withholding tax rates) overall had faster growth in wages.