Published on March 13, 2020

Although the widespread effects of the coronavirus pandemic are certainly of much more importance–and I plan to post shortly on the weakening withholding tax data as an early indicator of the economywide effects–I do want to comment on yesterday’s IRS release of data on individual tax refunds through filing season week 6, which ended on March 6. The data don’t show any significant movements: the dollar amount of refunds is down 1.3 percent compared to the same point in the filing season last year. Between half and two-thirds of refunds are usually paid out by now in the filing season, so there is getting to be less room for movement in the remaining weeks. The coronavirus effects will affect refund timing, so the data will get harder to assess in coming weeks.

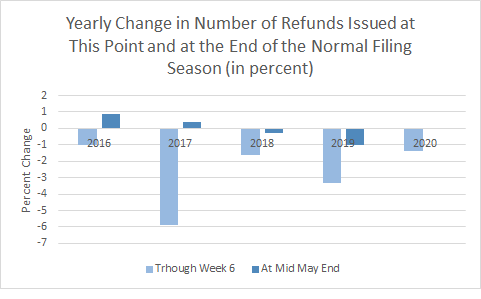

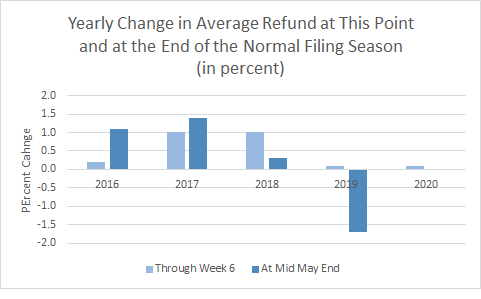

The total dollar amount of refunds is down because the number of tax returns with refunds is down by 1.4 percent (see first chart). The average refund is up by 0.1 percent, essentially the same as last year (see second chart). Neither of those movements is very significant. The combination explains the drop in the dollar amount of refunds of 1.3 percent.

In recent years, by the conclusion of the filing season, the number of refunds has not been up or down by more than a percentage point compared to the prior year. The change in the number paid out so far this year is just slightly below that range, and in each of the past four years the number of refunds has picked up later in the filing season. The number of returns processed by the IRS through week 6 is down by 0.5 percent, so that is roughly consistent with the decline in the number of refunds. And average refunds at this point in the season have been within a percentage point of the season’s ending point in three of the past four years; last year growth in the average refund dropped off late by almost 2 percentage points. That could suggest a rebound this year, if last year’s late drop was due to temporary, timing factors.

Given the impending delays in the tax filing deadlines in response to the coronavirus pandemic, and the disruptions to the filing season from the virus even without the filing delays, the weekly year-over-year refund comparisons could well become less meaningful from here on out.