Posted on February 7, 2024

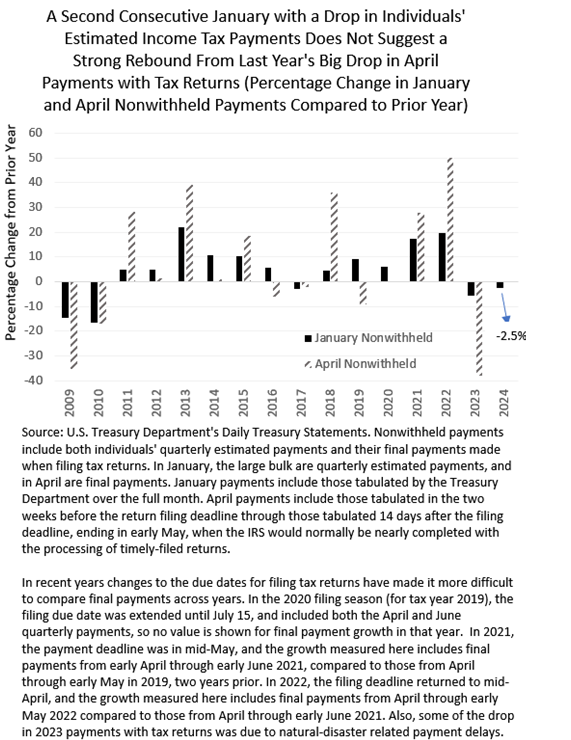

I’m not sure precisely what it portends, but we estimate that taxpayers’ final quarterly estimated payments of federal income taxes for tax year 2023 dropped in January by 2.5 percent compared to the amount paid in January 2023; we base that on daily tax receipts reported by the U.S. Treasury Department. From 2009 through last year, such amounts paid in January fell four times, and each time we saw declines in the subsequent April payment of income taxes with tax return filings (see chart below, with the category of “nonwithheld receipts” encompassing quarterly estimated payments and payments with tax return filings, along with relatively small amounts of payments of back taxes). Last year, quarterly payments in January fell by 6 percent and payments with April tax return filings declined by a whopping 38 percent (several percentage points of which was later identified as stemming from natural-disaster related payment delays). Payments with tax returns in April are so large and volatile that they often have a large effect on total federal revenue growth for the year.

It is difficult to tell if the small 2.5 percent drop in January estimated payments portends another drop in payments with tax returns, which would make it 5 out of 5 times since 2009. I wouldn’t, though, expect a big bounce back in payments with tax returns in April. On the one hand, the stock market fell markedly in 2022, presumably causing a large drop in realizations of capital gains and contributing significantly to the drop in April 2023 payments with tax return filings. The stock market in 2023, however, rose significantly, so that suggests a year (this year) of growing April tax payments. On the other hand, normally that would correspond to increases in estimated payments in January.

One can tell a slightly different story that supports a strong bounce back this April in payments with tax returns, but I don’t know how likely it is. It starts that taxpayers in 2023 lowered their quarterly estimated payments in response to the drop in April 2023 tax payments, and then they kept the quarterly payments lower all year–causing the identified drop in payments in January 2024 compared to January 2023. And estimated payments in January didn’t fall as much as they fell in the prior two estimated payments in June and September, so some taxpayers appear to have identified an increase in tax liabilities in 2023 and raised their estimated payments in January. Then, when many, especially higher-income, taxpayers’ taxes are calculated for 2023, they will find out that their tax liabilities actually rose for the year (thanks to capital gains and other incomes concentrated among higher-income taxpayers) and they wind up with large tax bills due in April. That was the story I thought might happen in 2010, when I was in the business of projecting these sorts of things; it didn’t happen, as lower quarterly estimated payments in January for the second year in a row presaged lower payments with tax returns, even with the stock market bouncing back the prior year (after the worst of the financial crisis). We’ll see if April 2024 is different.