Posted on October 3, 2024

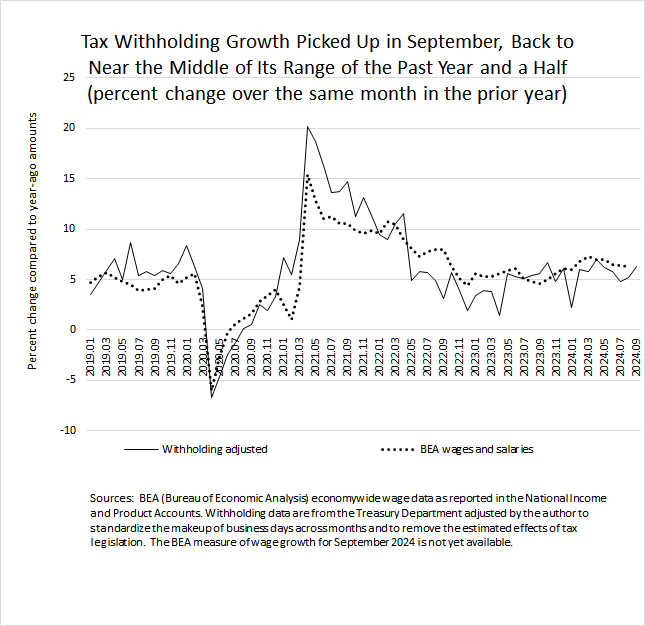

Growth in federal tax withholding–the combined amount of income and payroll taxes withheld from workers’ paychecks and remitted by the firms as soon as the next day to the U.S. Treasury Department–moved up in September. Based on data released daily by the U.S. Treasury, we estimate that the amount of withholding in September was 6.3 percent above the amount from September of a year ago (so-called year-over-year growth). That is above the year-over-year growth of 5.2 percent in August and 4.8 percent in July, and slightly higher than the middle of the range of 5 percent to 7 percent growth that we have measured in most months since May 2023. Thus, the recent withholding data are not indicating any significant slowing in economic activity.

It is difficult to interpret the day-to-day withholding data because they vary greatly depending on several factors unrelated to the state of the economy, including the payday schedules of businesses, the schedules by which different sized-employers must remit the tax withholding to the Treasury Department, and legislated tax law changes. As a result, the reported withholding data jump around tremendously from day to day and even from month to month. In constructing our measures of withholding growth, we adjust the reported withholding amounts in two ways: standardizing the makeup of business days across months and removing the estimated effects of tax law changes, though no such tax law adjustments have been needed in recent months.

Because federal tax withholding moves largely with overall wages and salaries in the economy, we expect that overall wages and salaries are growing at a relatively solid rate (see chart below). We get the first read on employment and wages for September in tomorrow’s employment report from the Bureau of Labor Statistics. The more comprehensive measure becomes available at the end of this month with the monthly release by the Bureau of Economic Analysis of its National Income and Product Accounts–though the data are subject to much subsequent revision.