Posted on December 5, 2024

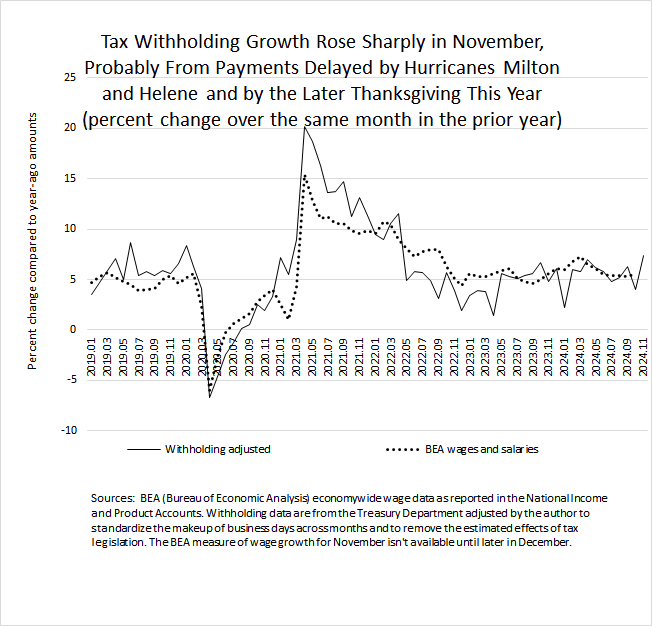

Growth in federal income and payroll tax withholding has bounced around much more than usual in the past two months, we believe in large part as a result of Hurricanes Milton and Helene, rather than from movements in the overall U.S. economy. In November, federal tax withholding–the combined amount of income and payroll taxes withheld from workers’ paychecks and remitted as quickly as the next day to the U.S. Treasury–was an estimated 7.4 percent above the amount from November of a year ago, which is the highest monthly growth rate in more than two years. That follows October’s unusually low growth of 4.1 percent relative to the amount from October 2023. As we posted last month, withholding growth was probably slowed in October in part by the effects of the two hurricanes. We are probably seeing some catching up of remittances in November. Over the two-month October-November period, tax withholding grew by about 5.7 percent above year-ago amounts, pretty centrally located in the range of 5 percent to 7 percent that withholding has grown in most months over the past year and a half. The late Thanksgiving this year, compared to last year, also probably contributed to some higher-than-normal increase in withholding in November.

Thus, we don’t have a good, close read on wages and salaries in October or November. Wages and salaries in the overall economy tend to move with federal tax withholding, absent law changes or other special factors. We adjust our estimates of withholding growth to remove the effects of law changes (with no such effects recently in any event) and to standardize the calendar across months, but not for other special effects. We’ll see what the U.S. employment report for November shows, which will be released by the Bureau of Labor Statistics tomorrow.