Posted on January 6, 2025

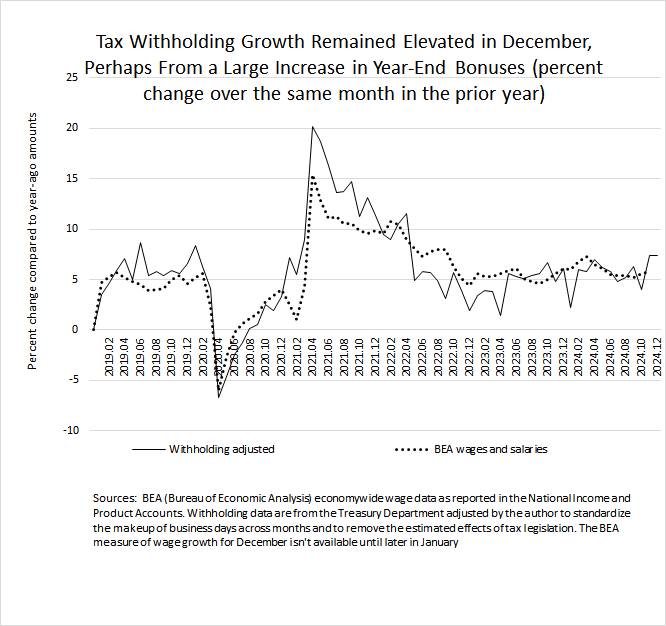

Growth in federal tax withholding remained relatively high in December, quite possibly the result of large increases in year-end bonuses in the financial industry. Tax withholding represents the combined amount of income and payroll taxes that are withheld from workers’ paychecks and remitted by firms as quickly as the next day to the U.S. Treasury Department. The overall amount of withholding is thus directly related to the economywide amount of firms’ payrolls. Based on data released daily by the Treasury Department, we estimate that withholding grew by 7.4 percent in December compared to the amount in December 2023. That growth is above the range of 5 percent to 7 percent that we have measured in most months since May 2023. Growth was also relatively high in November, at the same 7.4 percent, which we believe was caused by employer remittances that were delayed primarily as a result of Hurricane Milton in October.

If we are right in interpreting the recent strength in withholding as coming from financial industry bonuses, that suggests that payments with tax returns may be on the high side in the tax filing season in April. Bonuses are subject to withholding, but the withholding tax rate tends to be lower than the actual marginal tax rate of many recipients, who tend to have much higher than average income. We’ll see how much individuals pay in the fourth quarterly payment of estimated income taxes, which is due to the Treasury by January 15. If that amount is also elevated compared to last year, that would further suggest stronger payments in April.