Posted on April 20 2020

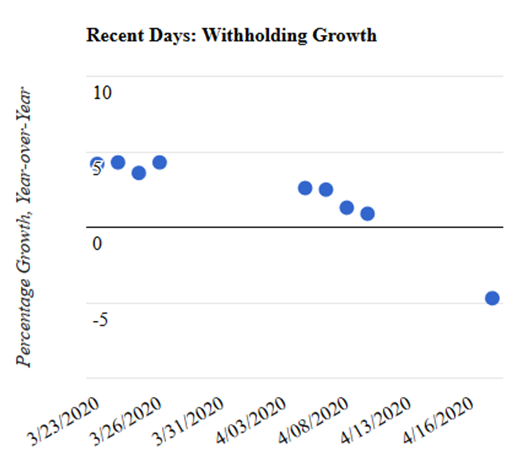

Withholding tax remittances have dropped precipitously, consistent with the severe contraction of the economy resulting from the actions to contain COVID-19. We obtain measurements of withholding growth each day this week, and the first one today shows that withholding has taken another step down: withholding is down by almost 5 percent compared to the same point in April of last year (see chart below). That measure of year-over-year growth has been moving down in recent weeks, and especially so since earlier this month. Falling withholding is consistent with falling economywide wages.

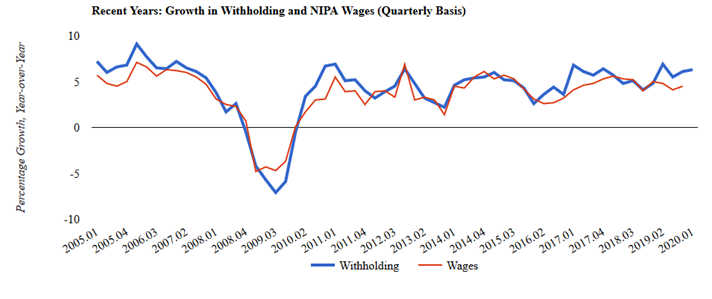

Withholding growth on that year-over-year basis has fallen by about 11 percentage points since late February, when it measured about (positive) 6 percent—near where it was for most of the second half of last year. The recent drop is consistent with about a 10 percent drop in withholding over the past two months, not surprisingly an unprecedentedly sharp drop for our measure that starts in 2005.

The withholding drop can result from job losses, reduced pay, and fewer hours worked per week, among other causes. If the entire roughly 10 percent drop in withholding since February has been from job losses, that would imply that employment was about 10 percent lower. If the size of the labor force remained unchanged, that would put the unemployment rate just into the teens. It’s possible that unemployment has risen by more because job losses are disproportionately hitting lower-income workers who face lower income tax rates; that development would lower economywide withholding taxes less than employment. Alternatively, the increase in unemployment could be smaller to the extent that individuals are still employed but at a lower number of hours or pay.

We’ll see what the remaining days of this week show for withholding. It is hard to see how withholding growth will revert up much, given that we use moving averages over a few weeks of data in order to reduce noise in the series and get a more reliable measurement.

Note that we adjust the withholding data to remove the estimated effects of the CARES Act that was enacted into law in late March. We make that adjustment because withholding growth on a constant law basis links directly to overall wages in economy (see long-term chart below of constant law withholding and wage growth through the first quarter of 2020). The provision of the CARES Act that allows firms to delay remitting their share of Social Security payroll taxes directly reduces withholding (but not wages). I am estimating that the substantial, roughly 15 percent, effect of that law change on withholding is phasing in through April, with about two-thirds of the full effect now built into withholding remittances. Having to estimate the effect adds some uncertainty to the constant law withholding growth measure. If we alternatively assumed that the effect has just now been fully phased in, the year-over-year decline in constant law withholding growth would today have been about a percentage point and a half less–so, closer to 3 percent instead of almost 5 percent.