Posted on July 15, 2020

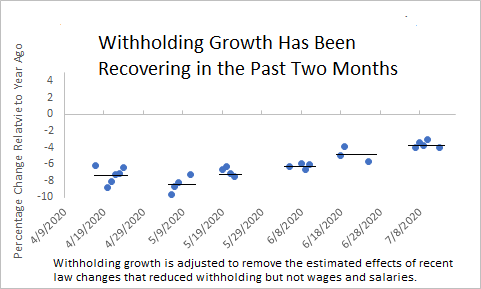

Our measure of federal tax withholding growth shows continued improvement in the first half of July, consistent with further recovery in economywide wages and salaries compared to the bottom of the cycle in late April/early May. We estimate that daily tax withholding was down by about 4 percent in the first half of July, compared to the same period in 2019. That marks steady improvement from declines of more than 7 percent recorded two months ago (see chart below). The measure of withholding growth removes the estimated effects of payroll tax deferrals and credits enacted into law in March that reduced withholding but not wages and salaries. Those adjustments allow a more direct comparison between tax withholding and wages. Without those adjustments, withholding growth would be about 4 percentage points more negative, though the same improvement over time would be evident. Despite the improvement in withholding, the economy has a long way to go before withholding growth is back to the roughly 6 percent (positive) growth recorded over most of the second half of last year and first two months of 2020.

Real-time data from certain parts of the U.S. economy are suggesting that the recovery has slowed in the past few weeks as coronavirus cases have increased and certain states have reimposed some restrictions in activity. Such other measures include restaurant bookings, hotel occupancy, and online driving direction requests. Such a slowing is not what we’re seeing from recent movements in tax withholding. The withholding data imply that wages and salaries have been growing in recent weeks. We’ll need to see if the withholding gains persist in coming days. We are now in the middle of the month when we do not get reliable measures of withholding growth (see methodology). We obtain measures of withholding growth for the second half of the month starting on Monday of next week and running through Tuesday of the following week.