Posted on July 20, 2020

Summary

- Withholding tax receipts in the week up to July 15 were so large that I think it is very possible that there was a misallocation of tax receipts in the daily revenue data and some of the strength in withholding may really have been in other revenue sources.

- A misallocation is made more possible because of the timing: just when tax receipts from other sources spiked because of the end of certain timing delays allowed by the IRS. Other possibilities for the withholding surge exist in this most unusual of years.

- The amount of receipts in the week up to the 15th were roughly $10 billion above the amount consistent with recent trends, which is about 5 percent of total monthly receipts.

- Until next month when we see the Treasury Department’s final, scrubbed monthly data for July, we will provide daily withholding growth estimates in two ways: using the reported daily data, and using a modified version continuing recent trends. Our withholding growth measure uses the previous several weeks of data, so an unusually strong week will continue to affect our measure for several weeks going forward.

In the week leading up to and including July 15, the daily data on withholding tax receipts, reported by the Treasury Department, took a sharp turn upwards. It was so much that it boosts our standard measure of withholding growth close to the positive territory for the first time since March. I am suspicious that the data are correct not only given the sharpness of the increase, when nothing in the economy seems to suggest such strength in corresponding wages and salaries, but also because of the timing. It hit just when individual and corporate taxpayers were making very large, unusually timed, payments following the expiration of several payment delays. This could be one of those very infrequent times when the Treasury Department discovers later that the daily receipts were misallocated between tax sources because taxpayers reported the allocation incorrectly, and then the Treasury corrects the data in the first part of the next month in the Monthly Treasury Statement. Even less frequently they even revise the daily data before reporting the amounts in the Monthly Treasury Statement. Until we see those data in the first part of August, we’ll be reporting our measure of withholding growth both using the reported data and using a modification of that week’s worth of data to line up better with recent collections. More details follow.

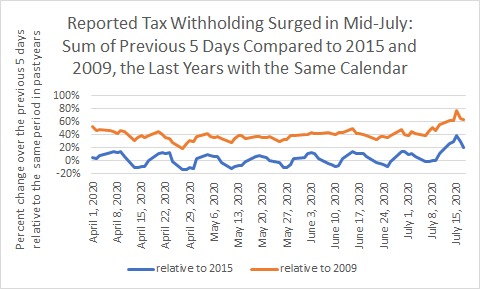

So, how much were withholding receipts boosted in mid-July? A lot, maybe by roughly $10 billion out of the $45 billion paid over that week. Withholding bounces around so much from day to day that is hard to track them in real time. They bounce around so much on a day-to-day basis because they depend so much on the day of the week and the timing within the month. The best metric I can identify for such short periods is to compare daily withholding receipts to those in months in which the calendar was the same–starting and ending on the same day of the week. The last time we had the same calendar as this year was in 2009 and 2015 (although those weren’t leap years, so the comparability only applies after February). Comparing withholding since April to amounts in those past years shows a sharp increase in the past week (see chart below for withholding in the previous five days compared to the same five days in those past years, expressed as the percentage increase in this year’s 5-day period). Compared to July 2009, receipts this month had been running about 40 percent higher, where roughly they had been for the past two months, but then that accelerated to 77 percent higher by the week ending on July 15. Withholding receipts came back down on the 16th and 17th, the latest two days (though the 5-day period remained elevated). The same basic story comes from comparing receipts to those in July 2015.

To get even further into the weeds, the way taxpayers report withholding can always result in misallocations. Employers must remit withholding amounts electronically, and they must identify which type of tax the payment applies to. It wouldn’t be surprising if some employers, who normally don’t remit corporate income taxes in mid-July, reported that all of the amount remitted was withholding when some was also corporate income taxes. Other misallocations could also occur. The last time we observed a major misallocation, in June 2019, it turned out that a significant amount of payments that were initially considered withholding in the daily data were really corporate income taxes, and the data were adjusted in the Monthly Treasury Statement for that month released in the first part of July 2019. It was about a $6 billion misallocation. Before that, I see only limited cases going back to 2005, and on a smaller scale than in June 2019.

This is an unusual year, to say the least, so other possibilities exist for the surge in withholding in the week leading up to July 15. There could be something about the recent legislative changes that caused major shifts, but there weren’t any expirations at that time. Related to recent legislation, some employers could have stopped deferring the employer Social Security payroll taxes and remitted all of the deferred amounts as one chunk, but it is hard to see how the effect would be that large. It could be normal variation–statistical noise–although that week in July would have much more noise than at all normal. One or more firms could have identified mistakes in the past remittances and made catch-up payments, but it would take some big firms to move the amounts that much. I don’t include the possibility that underlying wages and salaries could have increased that sharply.

Until we get information on the Treasury Department’s monthly tabulation for July in the first part of August, when they scrub the daily data for the month, we’ll be reporting our measure of withholding growth in two ways: using the currently reported measures from the Treasury Department and using a modified version that we estimated using typical amounts for the five days leading up to July 15. That modified version basically smooths out the recent increase shown in the chart above. We provide the modified measure because the unusually strong week will continue to affect our withholding growth measure for several weeks going forward; that continued effect occurs because we average withholding tax receipts over the past several weeks (see methodology).