Posted on January 7, 2021

The daily amount of income and payroll tax withholding from paychecks has been slowly but steadily recovering since April, and has taken a distinct jump upward since mid-December. We expect the jump to be temporary. The year-end bonus season generally makes withholding amounts move around temporarily. Acceleration of some wage income into 2020–a shift in the timing of wages in anticipation of higher federal tax rates in 2021– could also be an explanation. Another possible cause of the jump is the downstream effects of a provision enacted in the CARES Act back in March that allowed firms to defer remitting certain payroll taxes–which we would also expect to be a temporary effect. In any event, our tracking of daily withholding–in which we measure withholding growth over the past few weeks–is now showing that withholding amounts are running more than 5 percent above year-ago levels, a big jump from the 1 percent year-over year growth measured for the bulk of December–before much of the bonus payments, wage acceleration, or deferred payroll tax payments may have occurred in late December.

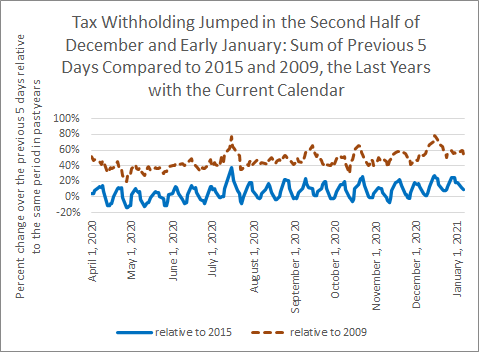

One way to see the recent jump in daily withholding is to compare amounts to those paid in December 2015 (and early 2016) and December 2009 (and early 2010)–the most recent years with the same calendar as today (see chart below). With the same calendar, we don’t need to try to adjust for the very volatile day-of-week effect–as Friday paydays cause Monday withholding remittances to the Treasury to be the largest day, and other calendar effects occur. (As it is, those comparisons still yield some regular oscillation because the importance of withholding on different days of the week and month changes over time.) Those comparisons show a move up in withholding this year starting in mid-December, though perhaps it requires a close look at the chart. Although withholding comparisons are shown relative to 2009 and 2015, the one to 2009 (the dotted brown line) is probably less instructive. Wall Street bonuses were rather weak that year given the financial market meltdown, therefore making this year’s bonus season look especially strong relatively. In 2015 (the solid, lower blue line), bonuses were more normal, and we see a smaller move up in 2020 relative to that year, but a clear move up nonetheless.

So, bonuses are the typical reason withholding moves up or down in late December and January. However, this Wall Street bonus season was largely expected to be very weak, which makes sense given the economy in 2020, not strong like the withholding data would suggest. A related factor would be the exercising of nonqualified stock options, which generate a gain to the (generally) higher-income employee and associated tax withholding. Although we have had a run up in the stock market, and perhaps some individuals have exercised options in December in anticipation of higher tax rates in 2021, exercises of stock options typically aren’t of enough magnitude to move withholding significantly.

Income shifting in general could also be a factor in the higher withholding. As a result of the recent election, perhaps some higher-income individuals are anticipating higher tax rates, and had some of their wages accelerated into 2020. That would boost the associated tax withholding amounts.

An alternative explanation could be the payment of deferred Social Security payroll taxes. As we’ve written about in a previous post, the CARES Act gave firms the option of deferring the remittance of the employer half of the Social Security payroll tax. The deferral period ended on December 31, 2020, but firms aren’t required to remit the deferred amounts for some time–half by the end of 2021 and the other half by the end of 2022. But firms may have had a tax motivation to repay the amounts by the end of 2020, in order to claim the income tax deduction for the amounts remitted. Other provisions of the CARES Act treated tax losses in 2020 more generously than losses in other years, so perhaps some firms paid the amounts back earlier than required in order to boost tax losses in 2020; in effect, they would obtain a short-term interest free loan from the federal government. To the degree those payments were made in late December, that would presumably just temporarily boost withholding.

Unfortunately, we never really know the reasons for many unusual movements in withholding. The key here is whether the movements are temporary or not, and while we assume the recent jump up, or at least much of it, will be temporary, only time will tell.