Posted on May 3, 2021

This year is the first year I’m aware of that individuals’ first quarterly estimated payments of income taxes were due on a different day than income tax returns were due. The first estimated payment this year was due by April 15, while the deadline to file an income tax return for 2020 was delayed until May 17. Normally both the first estimated payment and tax return are due on April 15, and last year both the filing deadline and the quarterly payment deadline (including the June quarterly payment) were delayed until mid-July. So, while taxpayers this year haven’t needed to file their tax return and pay any amounts due until May 17, it appears from the data that many taxpayers did indeed file their tax returns and pay in April as usual. As always, taxpayers receiving refunds have the incentive to file as early as possible, but here we are focusing on taxpayers who have to pay when they file their tax returns.

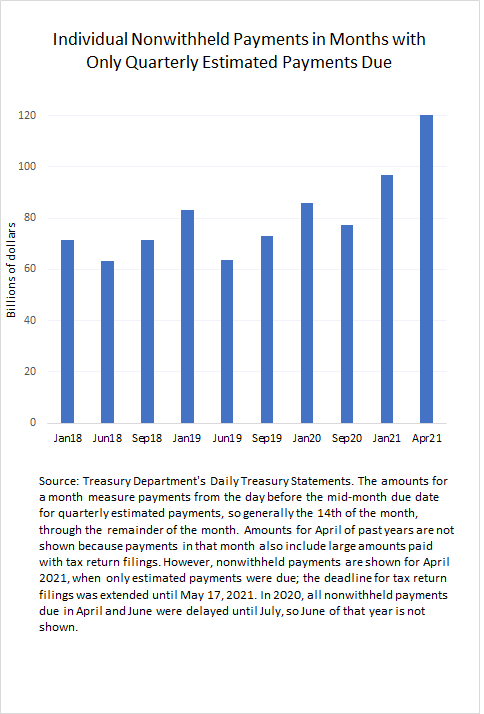

We can infer that many taxpayers paid earlier than they needed to because amounts of nonwithheld taxes paid in the second half of April of this year, measured from the day before the normal mid-month due date through the end of the month, were well above what a normal quarterly estimated payment would be (see chart below). When reporting the daily or monthly amounts paid, the Treasury Department doesn’t separate the quarterly payments and payments with tax returns–instead lumping them together into a category called nonwithheld payments; but we can get a sense of how big the quarterly payments alone would be in April based on the estimated payments in other months. The amount of nonwithheld taxes paid in the second half of April this year, $120 billion, was much larger than in other quarterly payment months. And we know from our time in government that estimated payments in April are normally smaller than in the other estimated payment months, not larger, presumably because many taxpayers apply their calculated refund from their tax return filing to their first estimated payment–rather than both getting a refund and paying tax at the same time; the government accounting treats such crediting of a refund to estimated payments as neither a cash payment or cash refund. Thus, the large amount paid in April makes it look pretty clear that many taxpayers filed their tax returns and paid in April, though it seems clear from other data (beyond the scope of what we are discussing here) that there is still plenty of money to be paid to the IRS with returns filed by the May 17 deadline.

Why file and pay early? First, I don’t think it’s because lots of people didn’t know in April about the allowed filing delay. During last year’s filing delay, taxpayers paid only $20 billion in nonwithheld taxes in the second half of April; they seemed to get the memo. At least part of the explanation probably involves the following: One problem with the different deadlines this year for tax returns and the first quarterly payment is that many people need to know how much their taxes were in the prior year in order to set their quarterly payment. One favorite strategy for higher-income taxpayers is just to set their four quarterly payments altogether (and including any income tax amounts withheld from wages) to equal 110 percent of their prior year’s income tax amount; under the tax rules, quarterly and withheld payments of that amount or larger would avoid any possibility of penalties and interest being applied from having a large tax amount due with the tax return. (That percentage is 100 percent for taxpayers with adjusted gross income of less than $150,000.) So, many higher-income taxpayers probably went through the normal practice of putting their tax return together–or, using passive voice, having it put together–in April.

Now, just because you put your tax return together early doesn’t mean you have to file early, and just because you file your tax return early doesn’t mean you have to pay early. You can file and schedule an automatic debiting from a bank account for a future date, like at the tax deadline. Or, you can even write a check (up to $100 million, which should cover most of us) and send it to the IRS along with form 1040-V after you’ve filed the tax return. There are lots of ways to pay. Perhaps many people figured that since their tax return was ready to go in April, that they would file it then, and, with interest rates being so low, make the payment due with the return (along with the quarterly payment) at the same time, and be done with it.