Posted on May 16, 2021

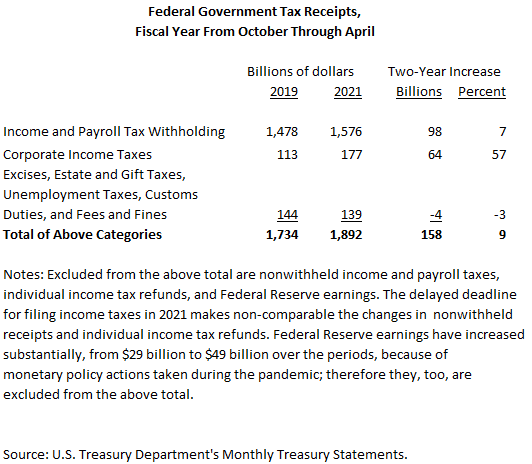

It’s very difficult to tell how total federal revenues are running compared to recent periods because of tax payment due date changes, legislative changes, and the effects of the recession. By my metric, however, federal tax revenues in recent months have been growing quite quickly, at least in those main sources for which we can make apples-to-apples comparisons. Specifically, I calculate that for the first seven months of the current fiscal year, so from October 2020 through April 2021, revenues for major revenue sources are about 9 percent above the amounts over the same period two years ago in fiscal year 2019 (see table below). That’s growth of about 4.5 percent per year on average, which is pretty comparable to how fast nominal GDP has grown on average over the past two decades. We compare recent revenues to those in 2019 because looking back to before the recession removes most of the confounding effects from the payment due date and legislative changes.

That 9 percent two-year growth in revenues is rather strong considering the recession. By comparison, GDP from the closest comparable quarters of fiscal year 2021 (October 2020 to March 2021) is higher by 3.6 percent over the same period in fiscal year 2019. The federal revenue amounts include all sources of revenue except individuals’ nonwithheld payments and refunds, which are heavily affected by the delay in this year’s tax filing deadline (which by the way is tomorrow in case you haven’t filed yet), and Federal Reserve earnings, which are heavily affected by the Federal Reserve’s large purchases of Treasury securities over the past year plus.

Most of the dollar growth in tax receipts over the past two years has been in income and payroll tax withholding from paychecks, which generally accounts for about two-thirds of total federal tax payments, but the largest percentage growth (excluding Federal Reserve earnings) has been in corporate income taxes.

Growth in income and payroll tax withholding of 7 percent over the past 7 months, compared to the same period two years ago, is high given the substantial unemployment from the recession. That revenue growth is even understated somewhat because of some payroll tax deferrals enacted in the CARES Act in March 2020 that were in effect through December 2020; those deferrals reduced revenues from October-December 2020 and don’t get reversed until starting at the end of this year. On a constant law basis, we estimate that withholding has grown by at least 9 percent over the past two years. By comparison, wages and salaries in the National Income and Product Accounts have increased by 5.4 percent over the comparable quarters of two years ago. My operating assumption is that the relatively high growth in withholding has occurred because higher-income taxpayers, who pay a very disproportionate amount of the income tax, have been doing much better overall in the recession than have lower- and middle-income taxpayers.

The very high growth in corporate income tax revenues, 57 percent over the comparable seven-month period of two years ago, is more of a mystery to me. The rapid growth could partly involve the asymmetries in the tax treatment of profitable and unprofitable firms, combined with how the recession and disruptions have significantly benefited some companies and seriously harmed others. Those firms that now have negative taxable profits have their income tax bills dropped to zero (disregarding the potential for eventual refunds of past taxes paid as allowed by the CARES Act), while those firms that have become more profitable pay more in taxes. That mix effect means that even if total economywide profits were unchanged, tax payments would increase on net because the higher tax payments by the more profitable firms would outweigh the lower tax payments of the unprofitable ones.

Over the next few weeks the IRS will be counting the money paid with income tax filings, and they will also get closer to closing the books on refunds with tax filings made by the May 17 due date. The amounts of those payments and refunds will be critical in determining how much overall tax payments will be for the full fiscal year.