Posted on June 29, 2021

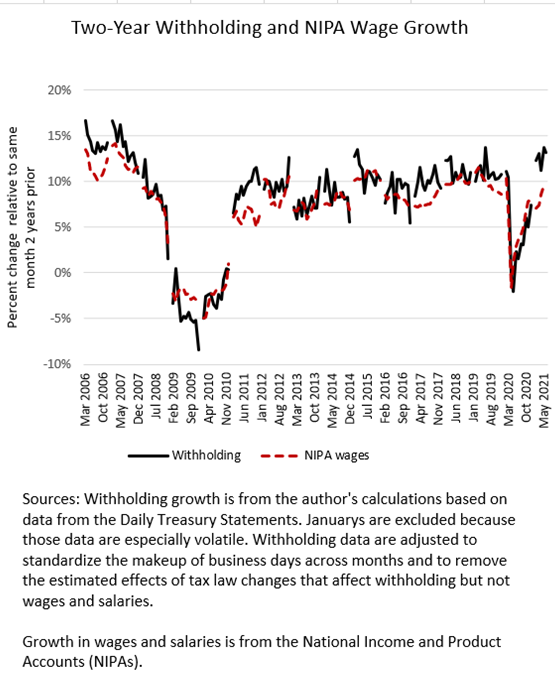

The amount of federal tax withholding–income and payroll taxes withheld from workers’ paychecks and remitted daily to the Treasury Department–remained strong in June, growing by an estimated 13.1 percent compared to the amounts in June from two years ago in 2019 (see chart below). That’s at or above two-year growth recorded pre-pandemic. We look at two-year growth to compare to a period before the recession; one-year growth rates are extremely high right now and difficult to interpret because they are measured relative to last year’s very depressed amounts of withholding. We adjust withholding to standardize the amounts for the number and makeup of business days across months, and to remove the estimated effects of tax law changes that affect withholding but not wages and salaries (see our methodology). Those estimated legislative effects on two-year growth are currently quite low, reducing withholding by less than one percent.

Wages and salaries as measured in the National Income and Product Accounts (NIPAs) are not growing as fast as withholding. Two-year NIPA wage and salary growth in May (June data are not available yet) is currently measured at 9.6 percent, when withholding growth was measured at 13.7 percent. We expect that some of the strength in withholding reflects a shift of earnings towards higher-income individuals, who face higher tax rates. Such workers have fared better in the past year’s recession and recovery, which is probably contributing to withholding growth substantially exceeding wage growth. The phenomenon of so-called real bracket creep, in which increases in wages that are distributed proportionately across the income distribution tend to push more income into higher tax brackets, boosts withholding growth above wage growth in a growing economy (a pattern seen through history); but the effect becomes even greater when the wage distribution becomes more skewed toward higher-income individuals. We’ll see if this trend continues in coming months.