Posted on July 18, 2021

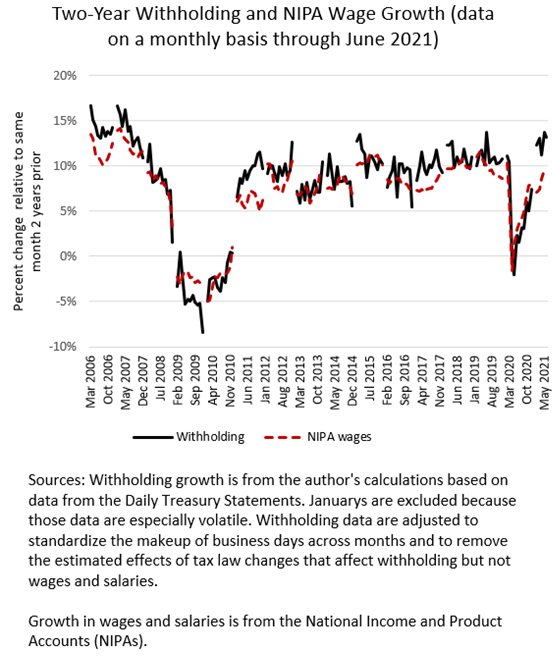

If you’re looking for signs of U.S. economic weakness, you won’t find them in the daily tax withholding data. It’s probably not a surprise, but economywide withholding growth in the first half of July continued at its recent strong pace, according to our calculations based on data from the Daily Treasury Statements. We measure withholding growth in the first half of July, compared to the amounts in the same period two years ago (in 2019), at between 13 percent and 14 percent, about the same as we’ve seen in recent months and at or above pre-pandemic amounts of growth (see chart below). That calculation standardizes the makeup of business days across months and removes the estimated effects of law changes that have affected withholding but not wages and salaries. (That law change adjustment is only 0.7 percent in July, the estimated revenue-reducing effects on withholding of the new employee retention tax credit that was not in effect in 2019.) We look at two-year growth to avoid the distorting effects from year-ago amounts that were depressed during the sharp downturn.

It is striking that two-year withholding growth has been at or above pre-pandemic amounts, and is significantly exceeding measures of economywide wage growth such as from the National Income and Product Accounts (NIPAs, again see the chart). By all accounts the number of employed individuals is lower today than two years ago, which would normally mean that wage and withholding growth since then would be negative or perhaps slightly positive given inflation and hourly wage growth. The strong recent growth in withholding relative to wage growth suggests that wages of higher-income taxpayers, who face higher tax rates, are growing substantially faster than those of other taxpayers. Historically, withholding growth has tended to slightly exceed wage growth in a growing economy because of the phenomenon of real-bracket creep, in which increases in inflation-adjusted wages that are proportionally distributed across different income groups have tended to push more income into higher tax brackets; that pattern has been accentuated when income gains have skewed more towards higher-income individuals. As an alternative, though less likely explanation for the recent growth in withholding exceeding that of wages, the recent move up in economywide prices raises the question of how much additional wage pressure there is in the economy and how well it is being measured by economic indicators such as NIPA-measured wages. First-quarter wage growth in the NIPAs will be revised in August when new data from the Quarterly Census of Employment and Wages become available; the annual end-July NIPA revisions could also modify measured wage growth (see previous post). We’ll see if those revisions close any of the gap between the measures of withholding growth and wage growth.