Posted on October 1, 2021

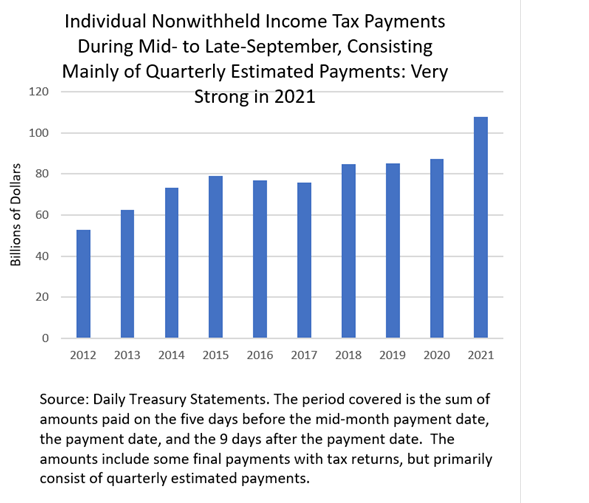

Quarterly estimated payments by individuals of income taxes continued to be strong in September, not a surprise given that the June quarterly payments were also strong. We estimate from the Daily Treasury Statements that individuals’ quarterly income tax payments–due by September 15 as usual, but it always takes the IRS a couple of weeks or so to count all the money–were about $107 billion during the mid-to-late September period this year, about 26 percent higher than the $85 billion recorded over the same period in September 2019, before the pandemic; and this year’s amounts were about the same percentage higher, 24 percent, when compared to last September’s amounts (see chart below).

I expect that the high growth in quarterly tax receipts in September largely reflects strong income growth of higher-income taxpayers, especially their nonwage income. (Taxes from wage income are largely reflected in tax withholding, a different revenue source.) Estimated payments in particular are very disproportionately made by higher-income taxpayers. In 2018, the last year for which we have relevant data from the IRS, about 95 percent of quarterly estimated payments by individuals were from those with more than $100,000 in adjusted gross income. Income tax payments overall are very skewed towards higher income taxpayers, as those with more than $100,000 in income in 2018 paid about 83 percent of overall individual income taxes. We conclude that overall nonwage income of higher-income taxpayers has been doing quite well over the past year. Those nonwage sources include capital gains realizations and income from businesses such as partnerships, sole proprietorships, and other pass-through businesses. We can only make inferences, however, because It takes a couple of years for the data on those taxable income sources to become available, as individuals file their tax returns next year and then the IRS processes and releases the data.

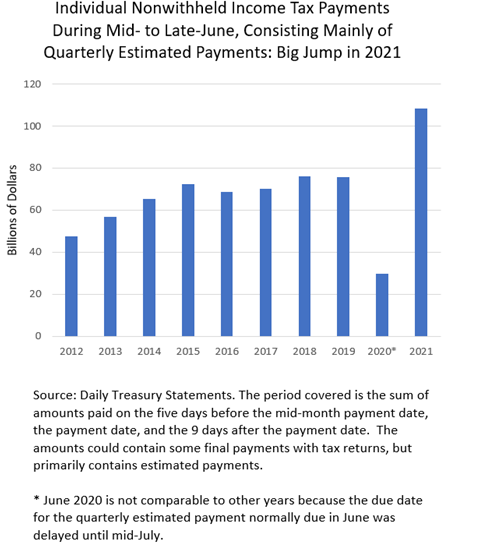

The strong September quarterly payment is not a surprise. The previous quarterly payment in June was also strong, even slightly stronger compared to previous June payments than was the September payment compared to previous September payments (see chart below). But strong is strong. We have seen strong receipts in recent months from all of the major federal tax sources–individual income and payroll tax withholding, quarterly estimated payments by individuals, quarterly payments by corporations for their income taxes, and final payments by individuals with their 2020 tax returns this past spring, Without those very strong tax receipts, the impending debt limit would have been hit much sooner. Treasury has incorporated the strong September receipts into their latest estimate for October 18 when their extraordinary measures to avert the debt limit will be very close to being exhausted. I doubt that the September payments were much of a surprise to Treasury, but having the payments in the books has given Treasury more certainty about their debt limit calculations.