Posted on December 19, 2021

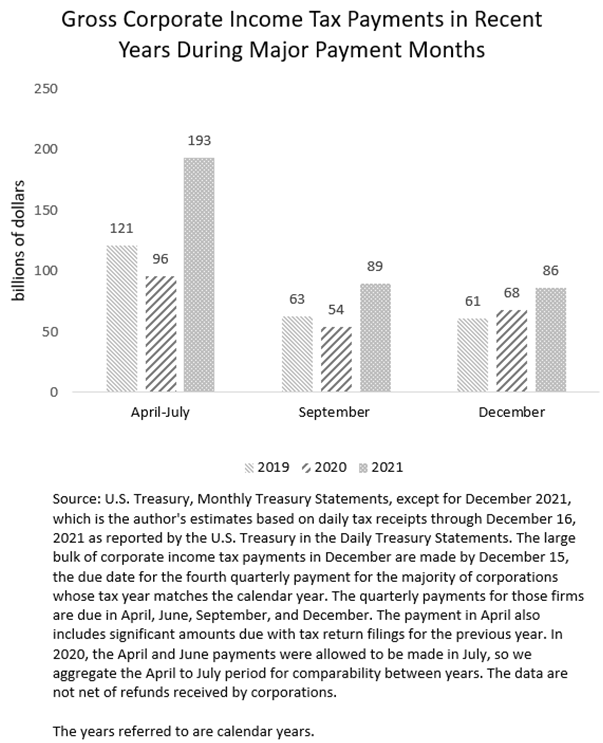

Quarterly payments of income taxes by corporations on profits in the fourth quarter have remained strong in December. Such payments in December, as in September for the third quarter, are about 40 percent above pre-pandemic amounts for the same month (see chart below). The December amounts this year are based on our estimates for the full month based on daily amounts reported so far in the Daily Treasury Statements; most all such quarterly payments in December are paid by the due date of December 15. The continued jump in corporate income tax payments indicates continued strength in corporate profits in the overall economy. For the majority of corporations, those whose tax year matches the calendar year, the December quarterly payment is the last one for 2021, following earlier payments in April, June, and September.

It may seem surprising that corporate profits are so much higher than before the pandemic, given the disruptions caused by the pandemic that you might think would weaken corporate profits. We’ve previously discussed the likely sources of strength in corporate profits, which include the following:

- Much higher commodity prices directly generate profits for primary producers as the higher consumer payments for the goods go directly to the producers’ bottom lines and have more limited effects on reducing profits of other businesses. Those commodities include agricultural raw materials (such as lumber), food, energy products, and metals.

- Subsidies provided to businesses by the federal government have boosted corporate bottom lines, if not to the firms that received the subsidies (a large portion of which was nontaxable to the recipient firms), then to the suppliers and other business customers to which the subsidies indirectly flowed. The slowing of such subsidies this year may be contributing to the slowing in corporate tax payments relative to amounts from earlier this year. Tax payments in the April-July period of 2021 were about 60 percent above the comparable period in 2019, more than the 40 percent gain in September and December.

- Booming asset prices, such as in stocks and real estate, have probably boosted capital gains realizations of corporations, which are taxable. In addition, mergers and acquisitions boomed in 2021, and they can generate capital gains for the businesses and their shareholders.

- And one factor increasing economywide taxable profits, though not true economywide profits, are shifts in profits between profitable and unprofitable firms. Such shifts increase tax payments for a given amount of overall (net) profits. Some firms have clearly benefited from the pandemic while others have been harmed, and only the profitable ones pay taxes.

All those factors boosting corporate profits and income tax payments have occurred while many workers have been able to successfully demand higher wages from businesses, which should put headwinds on corporate profit increases.