Posted on April 2, 2022

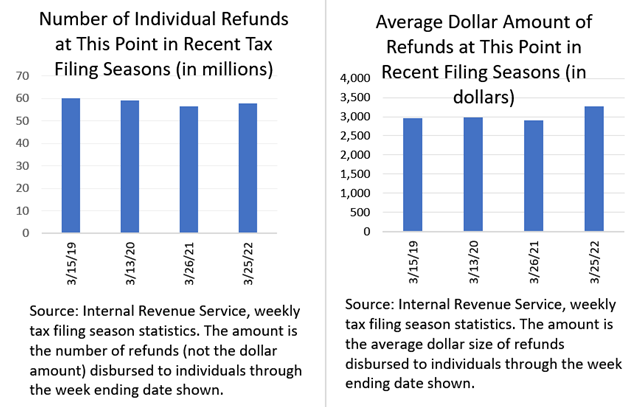

The Internal Revenue Service has disbursed about 58 million individual income tax refunds so far this tax filing season (through the week ending March 25). The average size of those refunds is $3,263, which is about 10 percent to 12 percent higher than the amount at the same rough point in the past three tax filing seasons (see chart below). That rate of increase has held steady over the past couple of weeks since we started tracking refunds this filing season. Refunds disproportionately go to lower- and middle-income taxpayers, and that jump up in average refund size is a boost to the economy, though the flip side is that it increases the federal deficit. As we described in more detail in a post two weeks ago, at least part of the increase in refund size probably reflects provisions of tax law enacted last year: a higher child tax credit; higher earned income tax credits, especially for childless individuals; and a higher tax credit for child care expenses. Increases in wages and prices in 2021 are also probably contributing to the increase in refunds in nominal (non-inflation-adjusted) dollars.

We are probably about halfway through the disbursements of refunds from tax filings for 2021. We’ll see if the average refund size continues to come in significantly higher than in recent years. Note that each of those three tax provisions that could well be boosting refunds were temporary for tax year 2021 alone. Thus, unless federal policymakers extend the provisions–and that is looking rather unlikely at present–we could be seeing a temporary jump in the average refund size. The increase in prices that has accelerated this year, however, would be expected to boost refunds next year in nominal dollars.