Posted on April 21, 2022

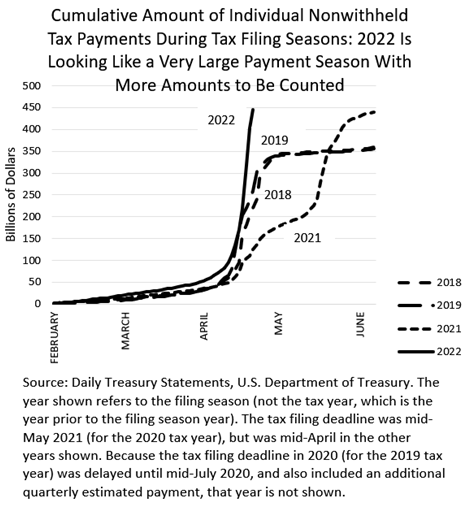

The counting continues of individual income tax payments with federal tax return filings that were due to the IRS a few days ago, but it is looking like a very high amount of payments will be recorded when the counting is completed over the next couple of weeks. The amounts paid by taxpayers this year since the beginning of February (roughly when the tax filing season begins) have totaled $445 billion through Wednesday, April 20 (reported by the Treasury Department on April 21, see chart below). With much more presumably still to be counted over the next couple of weeks, the 2022 amount so far is already about equal to the amounts paid through early June in the 2021 tax filing season. (The tax filing deadline in 2021 was delayed by a month, to mid-May, and most all of the amounts with tax returns were counted by early June.) In addition, amounts paid so far in 2022 are already 25 percent above the amounts paid and recorded through the entire 2018 and 2019 filing seasons through early June, when the tax deadlines were in mid-April like this year. When the tax filing deadlines are in mid-April, the amounts counted become relatively small after the first few days in May.

Despite the recession in 2020, the amount of payments with tax returns last year was high compared to amounts in recent years (see post from last year and reference to work we did with folks from the Brookings Institution’s Hamilton Project). The strength in payments so far in 2022 compared to 2021 is suggestive of even greater gains in tax year 2021–paid in the 2022 filing season–by higher-income taxpayers, who pay most of the income tax and an even greater proportion of final payments with tax returns. We expect that the stock market run-up in 2021, and the economic recovery, substantially boosted final payments with tax returns this year. We’ll see shortly if that is right. Note that we do not compare amounts paid to the 2020 filing season, which was delayed until mid-July.