Posted on April 23, 2022

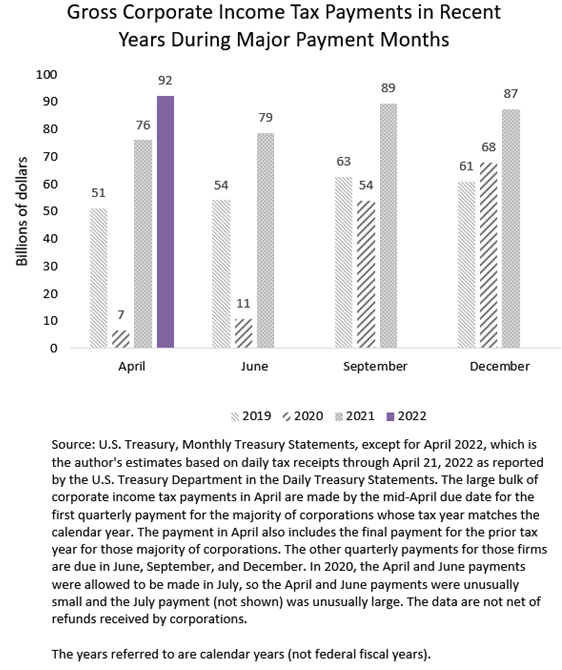

Most corporations made their first quarterly payment of federal estimated income taxes for the 2022 tax year in mid-April, and their final payments for the 2021 tax year were due as well. Those amounts in April reached $92 billion, we estimate, including some generally small amounts (an estimated $ 1 billion) to be paid between now and and the end of the month (see chart below, with the April 2022 amount highlighted in purple). (Those amounts just include gross payments, not net of refunds that corporations receive.) That $92 billion in gross payments in April would be about 21 percent higher than in April of 2021, a large increase that indicates substantial growth in corporate profits over the past year. However, that monthly growth rate in April is slower than in recent major payment months: 29 percent in December 2021 (compared to December 2020) and a whopping 66 percent in September 2021 (compared to September 2020). For those who follow the federal fiscal year that runs from October through September, that would put gross corporate receipts for the 2022 fiscal year through April at about 18 percent above the comparable period in fiscal year 2021. Refunds have risen some so far this fiscal year compared to those in fiscal year 2021, but we should still be seeing increases in net corporate receipts (which subtract refunds from gross receipts) above 15 percent for fiscal year 2022 through April compared to the same period in fiscal year 2021. Any way you count it, corporate receipts have continued to grow significantly and are way above pre-pandemic amounts.

Why are corporate profits and tax payments so high, and can they remain so high? There are at least several factors boosting corporate profits over the past year:

- Clearly inflation is part of the story of the increase The demand for goods has been exceeding the supply of goods, and that brings about higher prices (inflation) and thus an increased value of corporate sales. It’s not all gain, since businesses’ labor and other costs have been rising as well, but it appears that they have largely been able to pass the higher costs they face along to consumers, many of whom are flush with cash.

- Much higher commodity prices directly generate profits for the producers, where a given amount of production is sold at much higher prices and at production costs that are not substantially higher. Think oil, food, other agricultural raw materials such as lumber, and metals.

- Subsidies provided by the federal government to businesses in response to the coronavirus and recession boosted profits in the 2020 to 2021 period, but that effect should be waning. The waning effects should be lowering profit growth.

- Booming asset prices, such as stocks and real estate, boost taxable capital gains realizations of firms. They also boost demand for products by consumers (see first point of the imbalance of supply and demand).

- And the pandemic, recession, and recovery have re-aligned the profits of firms, for example away from certain travel-related industries and those needed to support a work-at-the-office economy, and toward stay-at-home related activities. Although that effect has been significantly waning, that re-ordering of profits means that we probably have more firms than usual that are experiencing losses and more than usual that are experiencing profits; since only profitable firms pay taxes, that would increase tax payments even if overall (net) profits remained the same.

Corporate profits will be facing headwinds in coming months. The recent rise in interest rates and prospect for higher rates in the future should be a significant drain on overall corporate profits, as the corporate sector is a net debtor. And if the higher interest rates substantially reduce consumer spending, that would be a double hit to corporate profits. The weaker stock market in recent months should be reducing funds available to higher-income taxpayers to spend on goods and services, also weakening corporate profits. The waning amount of fiscal support through subsidies, absent future law changes, should also hold down profit growth. In addition, labor shortages in many industries and the resultant additional pricing power of workers (that is, higher wages) should be putting downward pressure on corporate and other business profits.