Posted on July 6, 2021

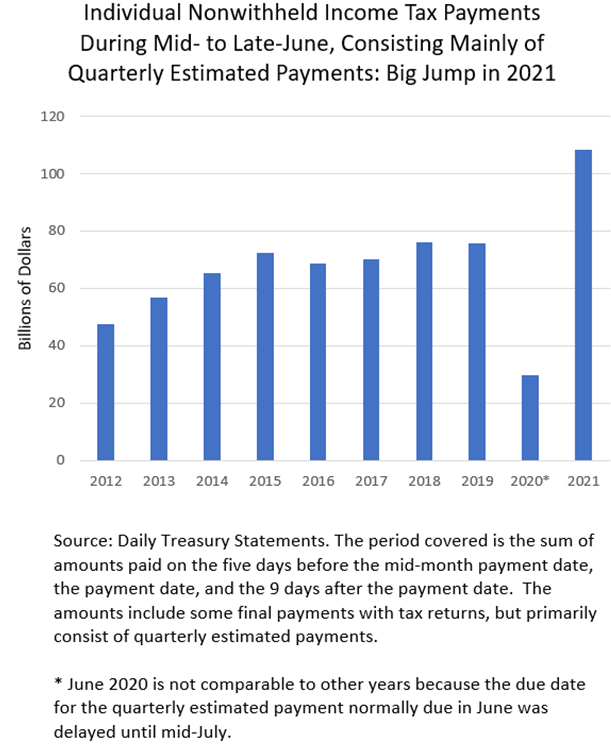

It’s becoming somewhat of a broken record, saying how tax collections from all different sources have been rebounding strongly in recent months, and particularly in sources that relate to higher-income taxpayers. Well, another data point along those same lines comes from individuals’ quarterly estimated payments in June. The payments were due by June 15, and it took the IRS a couple of weeks, as usual, to get the amounts counted and in the books. We can’t compare the amounts paid to those from June 2020 because the due date last year was delayed until mid-July, but the amounts were higher by about 43 percent compared to those from June 2019 (see chart below). It’s quite a jump to well above the amounts in recent history.

Although some of the big increase in June payments probably stemmed from this year’s delayed deadline for filing tax returns and paying amounts due, I expect that most of the jump is from big quarterly estimated payments resulting from large income growth of higher-income taxpayers. When reporting the amount of individual income tax collections, the IRS combines all payment types that aren’t withholding into a category called, appropriately enough, nonwithheld receipts. Those include both final payments with tax returns and quarterly estimated payments, along with all other miscellaneous payments such as from amended returns and the resolution of court cases and administrative actions. The IRS has said that many more tax returns than usual remained unprocessed at the end of May, due to the pandemic, and some of those returns will have had final payments that were processed in June and included in nonwithheld receipts; but it doesn’t look from the pattern of receipts that those amounts were particularly large. That’s because the pattern of the daily payments looked just like a normal June estimated payment month: small amounts in the first part of the month; increasing amounts in the several days before the payment deadline; big amounts recorded for a couple of weeks after the deadline, as the amounts were processed by the IRS; and then a rapid trail off in those collections to small amounts by the end of the month. It’s hard to see any steady processing of final payments superimposed on that pattern.

I’m left to conclude that the strong growth in nonwithheld receipts in June does not primarily stem from some anomaly related to the change in the tax deadlines or processing delays at IRS, but rather from strong income growth and quarterly payments of higher-income taxpayers. To be sure, estimated payments are made disproportionately by higher-income taxpayers. In 2018, the last year for which we have IRS data, about 95 percent of quarterly estimated payments were made by taxpayers with more than $100,000 in adjusted gross income. (Income tax payments overall are skewed to higher-income taxpayers, with 83 percent of tax liability in 2018 from taxpayers with income greater than $100,000.) I think that the June tax payments are yet more indirect evidence from tax collection data that higher-income individuals overall have done quite well through the recession and recovery. Other indirect evidence includes strong growth in tax withholding (see recent post), strong growth in individuals’ final payments with 2020 tax returns (see previous post), and surging corporate income tax payments (see previous post).