Posted on October 20, 2021

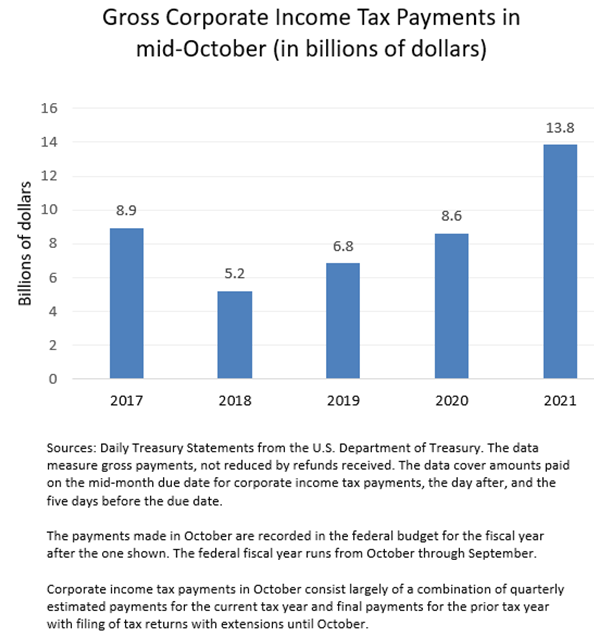

The mid-month payment of corporate income taxes continued to be very strong in October. We estimate, based on the amounts reported in the Daily Treasury Statement, that corporate income tax payments mid-month were up by about 60 percent compared to the payments in the comparable period in October 2020, and, perhaps a better measure, about twice the amount from 2019, before the pandemic (see chart below). Corporate income tax payments recovered quickly from the recession, and have been booming since then. The October corporate payment represents both quarterly estimated payments of taxes for the current year, as well as final payments from the prior year as many corporations file their tax returns with a delay until October 15 (although they would still need to pay amounts due by April 15 or face penalties and interest). Any way you slice it, corporate tax payments, and therefore taxable corporate profits, have been very strong.

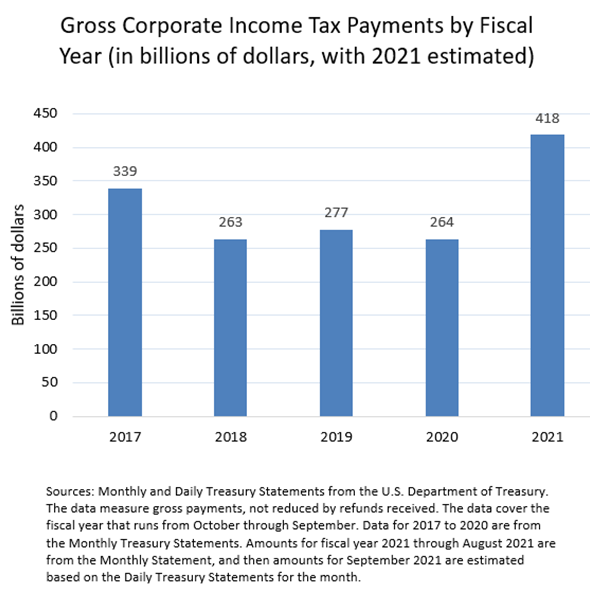

The October payment just continues the trend of booming corporate receipts over the past year (see chart below). Not only did corporate income tax receipts jump in fiscal year 2021 (with the fiscal year ending on September 30), they moved well above amounts even from 2017, before federal legislation reduced corporate income tax rates starting in tax year 2018. We discussed the strength in corporate income tax payments in fiscal year 2021 in a recent post, and attribute the increase to a number of factors: rising commodity prices; subsidies provided to businesses by federal legislation enacted since the pandemic hit; shifts in the mix of profits between profitable and unprofitable firms; and higher capital gains realizations. It will be a couple of years at least until tax return data become available that will help us understand better the surge in corporate income tax receipts.