Posted on June 23, 2022

In mid-June most firms made their second quarterly estimated payment of income taxes for the 2022 tax year, and the overall amounts paid to the Treasury Department indicate a slowing in recent months in the growth of corporate profits, the main driver of such tax payments.

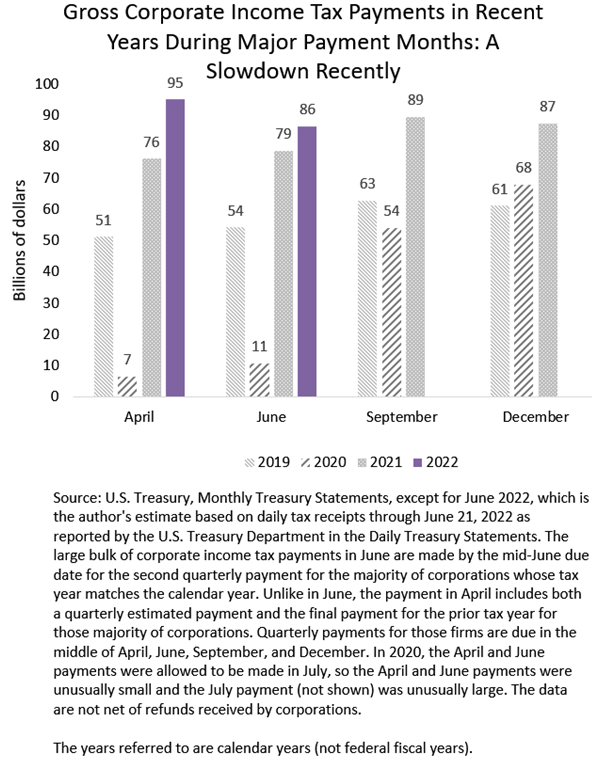

On the one hand, corporate income tax receipts in June were higher than they were last June, roughly 10 percent or so higher (see chart below, which includes estimates for the typically small amounts still to be paid in the remaining days of June this year). That increase in tax payments indicates that corporate profits have increased over the full year.

However, receipts in June didn’t grow nearly as much as they did in April, when they were 25 percent higher than the prior April’s amounts. That signals a slowdown in corporate profit growth in recent months. Another way to look at the slowdown is that tax payments this June were lower than in April, and by a significant amount, which didn’t happen in 2021 or 2019 (and ignoring the small April and June 2020 amounts given payment timing delays allowed in response to the pandemic). Such a decline from April to June is not a clear recession indicator, as receipts in June 2018 were lower than in April that year–although changing corporate tax rates could have contributed to that result. Changes to due dates for corporate tax payments starting in 2017 make older comparisons between receipts in April and June not meaningful. In addition, we can’t infer from lower June relative to April tax payments that corporate profits are outright dropping, because the April payments include some amounts of final payments that firms make when filing their tax returns. In any event, the signs are there of a slowdown in corporate tax payments and the corresponding profits.