Posted on February 18, 2021

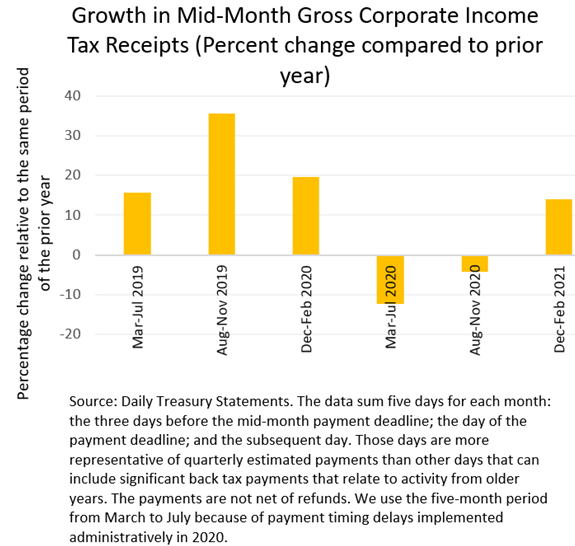

Gross corporate income tax payments–that is, the payments not reduced by refunds received–have rebounded over the past three months: the mid-month payment of income taxes by corporations has increased compared to year-ago amounts. January and February are small corporate payment months–mainly reflecting quarterly payments by the minority of firms not on a calendar year basis–but December is a major quarterly estimated payment month for firms that do their tax accounting on a calendar year basis. From December through February, we calculate that the mid-month gross payment of corporate income taxes was up by about 14 percent compared to the amount in the same period last year–so before the pandemic hit (see chart below). (We look at the payments around mid-month because they more likely stem from quarterly estimated payments, reflecting current profitability, than from back tax settlements and other idiosyncratic tax events that can occur at any time of the month.) Although payments in February fell slightly compared to year-ago amounts, the increases in December and January much more than offset that decline. So, basically, corporate payments in the past three months are running well ahead of pre-pandemic amounts, and even approaching the very strong pre-pandemic growth rates. And it’s not just a mid-month phenomenon. We estimate that for the fiscal year to date–thus from October 1 through mid-February–gross corporate payments are running some 17 percent above year ago levels. That suggests good profitability at the corporate level in recent months.

It gets a bit complicated, though, because the pandemic is boosting the performance of some firms but crushing others. If firms made profits and tax payments pre-pandemic, but then got hit hard by the recession, the most by which they can reduce their estimated payments to is zero. After that, they can use losses to get refunds of past taxes paid up to certain limits, but that is an involved and lengthy process.

So, what’s going on with refunds of past corporate income tax payments? Thus far this fiscal year, they have been higher than year-ago amounts, by roughly 18 percent, but the relatively small amount normally paid out by this point in the year makes that increase not very significant. The increase may soon become very significant, however. Thanks to the CARES Act, enacted in March of last year, firms with losses in 2018, 2019, and 2020 are able to get refunds of up to five years of past taxes paid, so as far back as 2015 for 2020 losses. It isn’t clear if all of the refunds for 2018 and 2019 losses have gone out to corporations yet, and the refunds from 2020 losses can’t be claimed until the firms actually calculate the amount and file their tax returns. (See a previous post describing those CARES Act provisions and the potential timing and amount of the budget effect.) Given the substantial losses that many firms were hit with in 2020, the refund amounts could be quite substantial.

Projections put out last week by my old employer, the Congressional Budget Office (CBO), have net corporate income tax receipts (that is, gross corporate payments reduced by refunds received) falling by about 23 percent for the entire 2021 fiscal year (October 2020 through September 2021) compared to fiscal year 2020. We estimate that net corporate receipts through mid-February this fiscal year have increased by about 17 percent, compared to the same period of a year ago, or about the same as gross corporate receipts have increased. There is certainly lots of time left in this fiscal year for the increase in net receipts recorded so far to reverse, and for the CBO projection to be realized for this very volatile revenue source–though one that is difficult to predict accurately even when the economy is not undergoing major swings and major corporate tax law changes haven’t recently been enacted. I wouldn’t be surprised if an expected significant increase in corporate refunds in the remaining months of the fiscal year, and perhaps very small final payments in April for the 2020 tax year, have a lot to do with that projection for a decline in net corporate receipts for the full fiscal year despite the strong start. Maybe the fine analysts at CBO have other good reasons for the projected decline in net receipts. It certainly would, though, be a big intra-year reversal for that revenue source. (CBO, as usual, has provided an excellent amount of tabular detail on components of their corporate income tax projection. Also, I would be remiss after my years at the agency not to say that the projection assumes that current tax law is unchanged by future legislation.) A big increase in refunds paid out this year, nonetheless, would be based on past economic activity, not current activity, which is why I would consider the recent rebound in gross payments to be a better indicator of current corporate profitability.