Posted on December 16, 2020

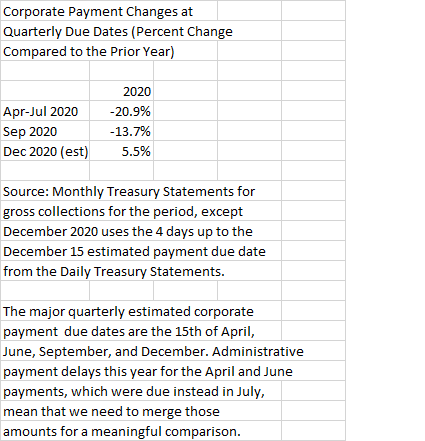

Here’s a quick note on a recent development in federal corporate income tax payments. The pandemic and associated economic effects caused a significant reduction in corporate income tax payments through the big September quarterly payment this year, but those receipts have rebounded in December. A major quarterly estimated payment due date just occurred on December 15, and receipts in the four days up to the 15th this year were higher by 5.3 percent compared to receipts in mid-December last year (see table below). That increase follows year-over-year declines of almost 21 percent from April to July, and about 14 percent in September. (Note that pandemic-related administrative delays in payments otherwise normally due in April and June, which instead all became due in July this year, mean that we need to combine receipts in those months for a meaningful comparison.) We don’t know the sources of the recent increase in corporate tax payments, but overall corporate profits are likely doing better than earlier in the year. Because these payments are based on the corporations’ estimates of their profits and taxes due for the full year, it is possible that the rebound in December means only that corporations had previously overestimated how poor profitability would be for the rest of the year. But even that would be a favorable indication of overall corporate financial health. Nonetheless, many corporations are doubtlessly still being hit hard by the economic downturn, while others have benefited from shifts in economic activities.