Posted on June 21, 2021

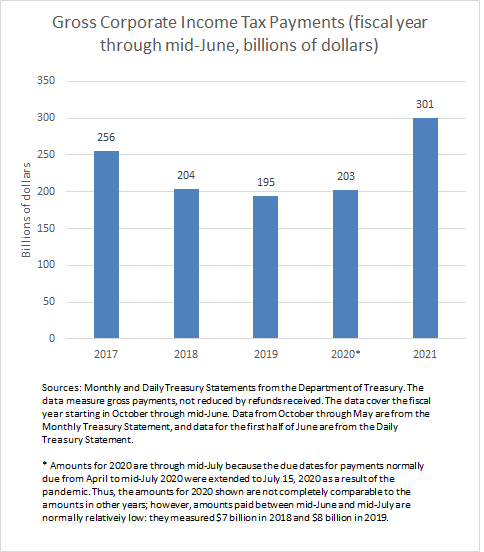

Federal tax collection data for the mid-June corporate estimated payment, the second quarterly payment for the tax year and third in the fiscal year, show that corporate income tax payments are continuing to surge. Corporate tax receipts didn’t slump in 2020, and now they are jumping well above pre-pandemic levels, by 50 percent or so (see chart below). Corporate profits as measured in the National Income and Product Accounts (NIPAs) were depressed in the first and second quarters of 2020, but since then, for 2020Q3 through 2021Q1, they have been measured at record highs, though probably not quite high enough to fully explain the jump in 2021 tax payments. And corporate refunds so far in fiscal year 2021 haven’t looked all that different from the amounts in recent years. With the next big quarterly payment due in September, that all adds up to gross corporate tax payments net of refunds for the full 2021 fiscal year (October 2020 through September 2021) being back at around $300 billion or probably a good bit above for the first time since the 2014-2017 period, before corporate income tax rates were cut substantially.

Understanding movements in corporate tax payments is very difficult in real-time, and it usually takes a couple of years to obtain the necessary data from tax returns to better understand the movements. But we can guess that the mix of corporate profitability in 2020 was shifted such that some firms became unusually profitable, while others became unusually unprofitable–and the NIPA profit measure is the net of the profits of profitable firms and the losses of unprofitable ones. Because only profitable firms pay taxes, that could have contributed to overall tax payments in fiscal year 2020 remaining relatively stable compared to 2018 and 2019 despite the two-quarter drop in profits. Then add in other components of corporate taxable profits that could be booming, such as capital gains realizations, which unlike with individuals are taxed at normal corporate tax rates, and which are not included in the NIPA definition of profits, and we can see how taxable corporate profits could have been roughly stable in 2020 and are now booming in 2021. In addition, price increases appear to be boosting corporate profits in 2021. A prime indicator there is the NIPA measure called the “inventory valuation adjustment.” I’ll spare you the details about the IVA measure, but for the past quarter or two it has been running at ahistorically large negative amounts, more reminiscent of when we’ve experienced oil (upward) price shocks. Commodity price inflation could be boosting substantially the profits of certain firms.

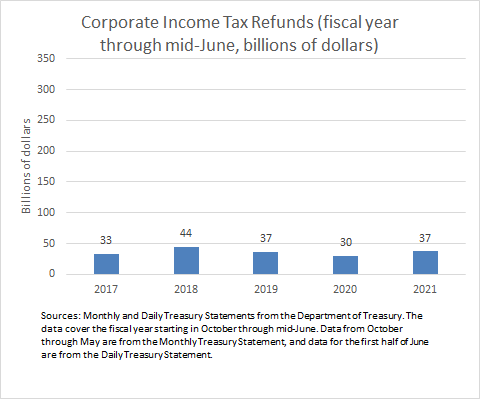

Meanwhile, corporate income tax refunds so far this fiscal year don’t look all that different from recent years (see chart below, using the same scale as the earlier chart). Last year we had expected the carryback refund provisions of the CARES Act to eventually cause corporate tax refunds to jump (see previous post). There still could be some in the pipeline for tax years 2018 and 2019, as the IRS processing of such refunds is necessarily very slow. And corporations that lost money in 2020, which could be a sizable number, will also be able to get refunds of past taxes paid as a result of the CARES Act–and we may not see a lot of those refunds until fiscal year 2022, as many firms won’t even file their income tax returns for 2020 until October. But all in all, lots of gross receipts and no jump in refunds in 2021 would mean a boom in net receipts, back to levels not seen since before corporate tax rates were cut substantially in late 2017.