Posted on April 5, 2020

Summary

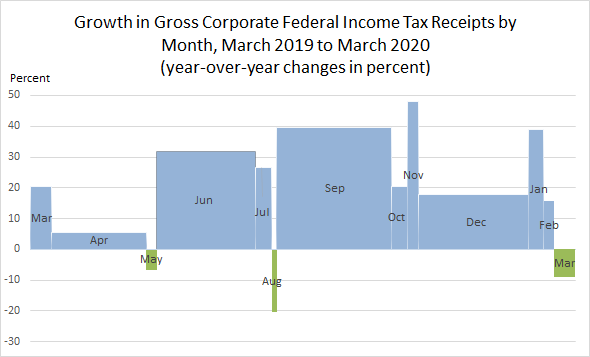

- Gross corporate income tax receipts fell by an estimated 9 percent in March (compared to last March’s amount), the first decline since August of last year.

- March is not one of the big four months for corporate income tax receipts, so we don’t normally put a lot of emphasis on movements in that month. But the decline in March is presumably just the beginning of even bigger declines in coming months.

After growing strongly for most of the past year, gross federal corporate income tax receipts, which reflect corporate taxable profits, fell by about 9 percent in March, according to my estimates based on the Daily Treasury Statements (see chart above). That measures gross tax payments by corporations; that is, they are not reduced by refunds the firms receive, which often result from idiosyncratic factors related to old economic activity. (Refunds should soon begin to grow very sharply as a result of enactment late last month of the CARES Act, which allows firms with losses in 2018, 2019, or 2020 to use such losses to receive refunds of up to five years of previous taxes paid.)

Corporate income tax receipts in March are typically quite small, so we don’t usually draw many conclusions from movements in that month. Most corporations choose to have their tax year match the calendar year, which means that they make big quarterly income tax payments in April, June, September, and December. Their final settlement of taxes for the prior year also occurs in April. Receipts in March largely represent quarterly payments by firms that have chosen other 12-month periods for their tax year. Receipts in the small payment months can often fluctuate significantly because they can be affected by special factors that affect a small number of large corporations.

Despite the relatively small nature of corporate income tax receipts in March, we can only infer that the decline in such payments this March results from the economic effects of the novel coronavirus. Receipts had been growing significantly in recent months. If anything, I’m a bit surprised that the receipts didn’t drop by more in March. When a corporation’s managers determine how much to remit as quarterly income tax payments, they can be forward looking and significantly reduce or eliminate payments for the quarter if they expect their firm to be suffering losses very soon. Perhaps the upcoming consequences of the coronavirus on profits weren’t as obvious in mid-March, when the tax payments were due. In addition, for some firms, the payment in March is the final quarterly payment at the end of the corporation’s tax year or is a final settlement of the prior year’s activity, so the profits after March do not affect the required payment.

In any event. we can only expect the declines in corporate tax receipts in coming months to be even bigger, and especially so measured on a net basis that incorporates an almost guaranteed spike in refunds of past taxes paid.