Posted on February 14, 2020.

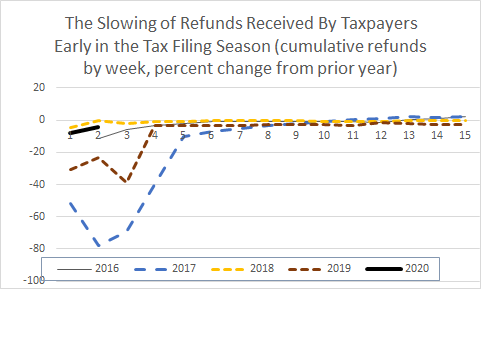

Although it is way too early in the 2020 income tax filing season–which began at the end of January–to say much about tax refunds, we can say that the early IRS data releases show a continuation of the trend in recent years for taxpayers to receive refunds later and later. The dollar amount of total refunds through just two weeks of the filing season is down 5 percent from last year’s total amount at the same point (see chart). In recent years, refunds have dropped more and more at the beginning of the filing season, sometimes by big amounts. Then refunds catch up later.

A little history first: legislation enacted in 2015 required the IRS to delay until mid February refunds to taxpayers who claimed the refundable earned income or child tax credits, an especially lucrative source of fraud by the bad actors. That caused a marked slowdown in the dollar amount of refunds early in tax filing season 2017 (see chart), when the requirements first went into effect. But refunds were paid out very slowly again last year, perhaps from some combination of the five-week government shutdown that ended right before tax filing season began, changes in the tax law that included additional refundable child tax credits, and additional filters instituted by the IRS to delay refunds that might indicate fraud. Some taxpayers may also have slowed their submission of returns as they’ve learned of the mandatory delay in refunds for returns that included the two refundable credits. (The chart above shows changes in the dollar amounts of refunds, rather than number of returns with refunds, but the number of refunds has been progressively down as well early in recent filing seasons.)

I thought it was quite possible that the early pace of refunds would pick up this year compared to last year, because most of those identified sources of the major delays last year should either be temporary or at least not slow refunds further. Nonetheless, the first two weeks of this year’s filing season show a continued slowing of refunds, though on a much smaller scale, 5 percent, than in two of the past four years. Maybe more taxpayers are delaying their tax filings given the mandated delay in processing returns with the two refundable credits.

Presumably refund amounts will pick up very soon. We’ll track refunds at points during the tax season, but it is too early to be able to assess the underlying movements in refunds, separate from the initial timing effects.