Posted on December 27, 2022

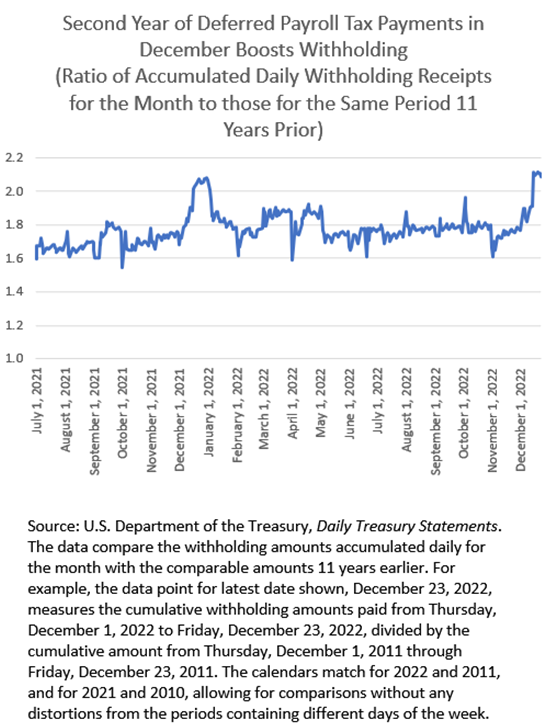

We can observe that daily remittances to the U.S. Treasury made by employers for the federal income and payroll taxes that they withhold from their employees’ paychecks (referred to as withholding) are being significantly affected in December by previously-enacted law changes. For the second consecutive December, federal withholding amounts have been boosted substantially by a provision of the CARES Act, enacted in March 2020, that allowed employers to elect to defer payment to the Treasury of the employer share of Social Security taxes that they otherwise would have been required to remit from the end of March 2020 through December 2020. The legislation didn’t require immediate repayment after December 2020 of the deferred amounts, but rather required that at least half of the deferred amounts be paid by the end of December 2021, and the other half by the end of December 2022. As a result, daily remittances jumped in December 2021 and again in December 2022, with a week of receipts this year still to be remitted and tabulated (see chart below). So, if you have observed a big boost in federal withholding receipts this month compared to receipts in Decembers prior to last year, it doesn’t mean that bonuses or underlying wages have jumped, but rather reflects at least in large part the end of that legislatively-allowed deferral period. Because it happened last year as well, perhaps to a very similar extent, this year’s withholding growth rate over last December may not be significantly affected. In December 2023, though, we can expect a big drop off in withholding compared to this December as a result of this factor.

For more details, the way I measure the December boost from the payment of the deferred amounts is by comparing the daily amounts paid by month this year to those paid by month in 2011, and those paid last year by month to those in 2010–accumulating the daily amounts paid up to each day of the month. I make the comparison to those from 11 years prior because those years were the most recent ones with the same exact calendar; that keeps the comparison periods always with the same number and positioning of days of the week. Withholding bounces around so much depending on the exact calendar that it is difficult to otherwise find a comparable period. Since May 2022, withholding amounts remitted to the Treasury on average have been about 1.75 to 1.8 times the amount paid in 2011, but in December 2022, payments started jumping well above that level in the second week of the month. This year from December 1 through December 23 (the last day for which we have data), withholding amounts were about 2.1 times those through the same period in 2011, a significant jump (again, see the chart below). The same, temporary phenomenon occurred last December.