Posted on June 8, 2020

Summary

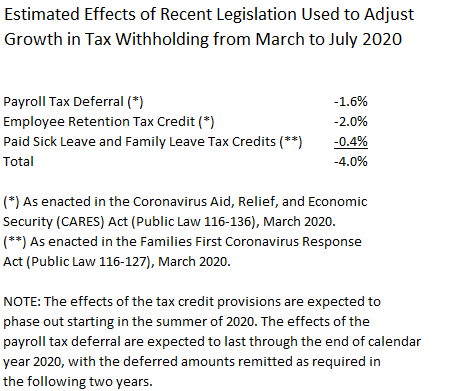

- We now estimate that recent law changes have reduced withholding growth by about 4 percentage points, compared to the 8 percentage points we had previously been estimating.

- That change makes larger our estimates of the recent decline in withholding, adjusted to remove the effects of recent law changes. In effect, we attribute more of the observed total drop in withholding, which includes the effect of law changes, to underlying economic conditions and less to the effect of the recent law changes.

- The largest change is that we estimate that few firms are utilizing the provision of the CARES Act that allows all businesses to defer, for an extended period, remitting their share of Social Security payroll taxes.

- The largest effect on withholding from recent legislation, we estimate, is from the employee retention tax credit, specifically utilization by large firms that have furloughed workers and continued to cover their health insurance benefits.

To make our estimates of tax withholding growth useful in tracking the U.S. economy, we adjust the withholding estimates to remove the estimated effects of recent legislation that affects withholding but not wages. In that way we have a measure of withholding growth on a constant law basis that we can then relate to growth in the amount of economywide wages, the most important determinant of withholding. Such legislation has affected withholding growth for about one-third of the period since 2005 that we track. To that end, we have just lowered our estimates of the effects on withholding of the federal legislation enacted in March that provided coronavirus-related relief to individuals and businesses. Specifically, we had been estimating that the provisions reduced withholding by about 8 percent, and now we are estimating that effect to be about 4 percent instead (see table below). That change makes our estimates of the recent decline in withholding, adjusted to remove the effects of recent law changes, larger; in effect, we attribute more of the total drop in withholding, which is what we observe from the data and which includes the effect of law changes, to underlying economic conditions and less to the effect of the recent law changes. We make that revision primarily based on early indications from financial statements and from total withholding amounts that the previous estimates were too large. The change affects our historical estimates starting in April and going forward.

Most significantly, we have reduced our estimates of the effects of the provision of the CARES Act that allows all businesses to defer, for an extended period, remitting their share of Social Security payroll taxes. We posted last week about how business financial statements are providing enough indication for us to conclude that firms are not taking much advantage of the allowed deferral, which is consistent with the observation that overall tax withholding has not dropped anywhere near enough to be in line with the original Congressional estimates of the effects of the provision. Clearly the Congressional estimates of the recently-enacted provisions affecting withholding were much more uncertain than usual given the unique issues of the business response to the provisions and the course of COVID-19 and the public health policy response. We estimate that the deferral provision is reducing withholding growth by about 1.6 percentage points, consistent with roughly 10 percent of firms (weighted by the amount of their wages paid, to be precise) deferring the tax remittances. We infer that the original Congressional estimates (which we had already significantly reduced for our purpose in April) assumed that most all firms would take advantage of the provision.

We also now estimate that the payroll tax credits provided by the CARES Act along with the Families First Coronavirus Relief Act (FFCRA) are reducing withholding growth by about 2.4 percentage points. Most of the effect is from the employee retention tax credit (ERTC), and specifically from large firms that have furloughed workers and continued to cover their health insurance benefits in the meantime, or at least for some period of time. Firms with more than 100 employees can claim the ERTC only for compensation paid to workers who are not working, effectively on furlough; health insurance benefits paid by the firm qualify. The revenue effect of the credits should wane as the year goes on because the amounts of the credit are limited to a dollar amount per employee for the year and firms are only eligible for the credit if they have either a big drop in business receipts or are subject to government shutdown orders in a quarter. Under current law, the credits cannot accrue after the end of the calendar year. There is the potential that some firms may be studying whether they qualify for the payroll tax credits and start reflecting them in withholding later in the year, a development we’ll need to be looking for with various sources of information.

We estimate that smaller firms–those with 100 or fewer employees who can also claim the ERTC for amounts paid to employees who are still working–will generate fewer ERTCs than larger firms. Information from the Small Business Pulse Survey, undertaken by the Census Bureau, and from financial statements suggest to us that few small firms are taking advantage of the payroll tax credits (unlike a significant take-up of the Paycheck Protection Program and the Economic Injury Disaster Loan program). Indeed, the small firms who are utilizing the Paycheck Protection Program are ineligible for ERTCs.

We estimate that the tax credits for paid sick and family leave, as provided by FFCRA, are having a much smaller effect on revenues than the employee retention tax credits. That is based on a range of information, including estimates by the Center for American Progress on the overall number of employees potentially subject to the FFCRA credits and Census information on the share of employees with young children in need of care during the government-mandated shutdowns.

To see how the updated estimates of law changes have affected the daily estimates of tax withholding growth, adjusted for law changes, see this spreadsheet. Withholding growth without the adjustment, which we also report on a monthly basis, is unaffected by the adjustment for tax law changes.