Posted on June 24, 2020

Summary

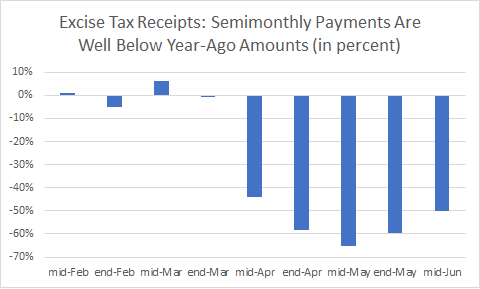

- Excise tax collections have been down substantially during the pandemic, by 50 percent compared to year-ago levels for the most recent semimonthly payment in mid-June.

- The decline has occurred for three main reasons: a legislated suspension of aviation-related taxes through the end of the year; an administratively-allowed delay of payments of alcohol and tobacco taxes through the end of June; and lower amounts of gasoline taxes as people have been driving much less and refiners therefore producing much less fuel.

- The lack of aviation, alcohol, and tobacco tax collections in the past 2-3 months allows us to isolate more closely than usual the effects of motor fuels on total excise tax collections.

- The drop in excise tax collections has been moderating in recent weeks as gasoline production has partially recovered, and the end of the delay of alcohol and tobacco taxes next month should moderate the decline further.

Lets go into the weeds of excise tax collections. They have dropped significantly along with most other sources of federal revenue during the pandemic. Excise tax collections overall were down by about 50 percent in the latest semimonthly payment in mid-June, compared to the mid-June payment of a year ago. That’s actually an improvement from the 65 percent drop two payments ago, in mid-May (see chart below). (Yes, excise taxes are generally paid twice monthly, covering activity occurring between two and four weeks before.) That improvement corresponds with increases in gasoline production, which has recovered a good bit from the sharp drop-off of a couple of months ago. Indeed, excise tax payments temporarily consist largely of gasoline and other highway-related taxes, given the administrative and legislated actions taken that have temporarily eliminated payments of the other main sources of excise tax receipts.

First some background: Excise taxes, which account for only about 3 percent of total federal revenues, consist of more than 50 separate tax sources, but the large bulk of the revenue comes from highway-related taxes (almost 50 percent, with about two-thirds of that from gasoline taxes), passenger air travel and related taxes (about 20 percent), and alcohol and tobacco taxes (about 25 percent combined).

As we discussed in a post in early May, it isn’t hard to see how excise tax collections have been down so much. Right off the top, excises are currently down by 45 percent from aviation, alcohol, and tobacco taxes. First, the CARES Act, enacted in late March, suspended the aviation-related taxes through the rest of the year, so that generates a 20 percent decline in overall excise tax collections. (Those receipts were clearly going to be way, way down even without the tax suspension.) In addition, alcohol and tobacco producers have been allowed by Treasury Department administrative action to delay by 90 days their required semimonthly payments otherwise due through June; so, for example, the payment originally due April 14 is now due on July 13, and the payment normally due on June 29 (the last one that can be delayed) is instead due on Monday, September 28 (if you’re counting, the 90th day occurs on a weekend). That means another 20 percent loss in excise tax revenues through June.

The rest of the decline in excise tax collections can presumably be traced to highway-related taxes, mainly gasoline taxes. Because the Treasury Department doesn’t know the components of the excise tax payments except with a lag of several months–they initially just know the total amount of excise tax payments–the temporary loss of those three other tax sources lets us see if we can directly link the remainder of decline in excise tax collections to gasoline taxes.

The gasoline tax is not assessed when consumers buy the gasoline at the pump, but rather is assessed (in general) on the refiners when the fuel gets loaded onto trucks and trains at the “terminal rack”, which basically consists of the storage tanks to where the refiner pumps the fuel for distribution. Having a limited number of taxpayers (the refiners) aids in tax compliance, but rest assured that drivers bear the burden of the tax.

Anyway, we can get weekly measures of the amount of gasoline refined from the Energy Department’s Energy Information Administration. (They have several different measures available, but that one linked appears closest to the taxable amount of gasoline.) Not surprisingly, the refined amount has been way down since the pandemic started, and decreasingly so recently (see chart below). The low point was in the first half of April, when production was down by 40 percent or so, and production has gradually recovered to being down by 20 percent in the last weekly period ending on June 12 (see the second chart below for percentage changes measured over half month periods, like how the taxes are paid).

The decline in gasoline production doesn’t link up perfectly with the drop in excise tax collections not attributed to aviation, alcohol, and tobacco taxes, but it comes close. For example, refinery production of gasoline was down by about 25 percent in the second half of May, and, given that taxes are due on that about 15 days after the end of the half month, that contributes about 8 percentage points to the drop in total excise tax collections in the mid-June semimonthly payment. (-8 percent = -25 percent times the highway tax 50 percent share of total excises times the two-thirds share of highway taxes coming from gasoline taxes). So, I see a 53 percent drop in total excises in the mid-June payment coming from aviation, tobacco, alcohol, and gasoline taxes. That compares to the 50 percent decline in the mid-June total excise tax payment. There could be another percent or so decline in excises from diesel fuel–I’ll spare you the math–but we do see a pretty close correspondence of the total drop in excise taxes and what we can identify. It’s not a perfect approximation, though, as we under-explain the drop in the mid-May excise tax payments, which were down by about 65 percent. Gasoline production was down by 32 percent in the second half of April, so that contributes to about an 11 percent decline in total excise tax payments in mid-May, which when added to the other sources would yield a total decline of 56 percent (not 65 percent). Our approximation there may be missing some for any number of reasons, including that gasoline production doesn’t immediately get taxed because it needs to be pumped to the terminal rack and then distributed, and most but not all gasoline production is taxed. In any event, we can see the link between gasoline production and the subsequent excise tax payment. Normally with multiple taxes included in the tax payments, we can’t isolate one component very well.

Given that gasoline production continued to improve in the first half of June, that would imply some continued small improvement in total excise taxes in the end-June excise tax payments due by next week. Specifically, gasoline production was down by 20 percent in the first half of June, compared to being down by 25 percent in the previous half month.

Next month the alcohol and tobacco tax payments start coming back. If the producers defer those tax payments as long as possible–yes, the producers pay those taxes, too, but pass the tax largely along–then we’ll see six consecutive semimonthly payments with effectively 2 payments each: one payment will be on the normal schedule and one will be for a payment deferred during the April-June period. Alternatively, perhaps some producers will decide to just make all the delayed payments at one time upfront. In that latter case, total excise tax collections could temporarily jump above the corresponding amounts from a year ago. But we’ll only be able to infer the activity for any type of excise tax from the total amount paid.