Posted on April 22, 2021

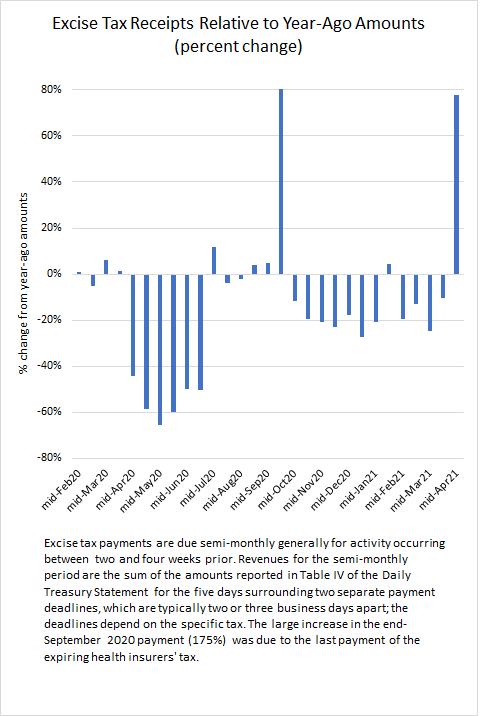

It is looking like payments of excise taxes are recovering well. The past two semi-monthly payments have improved substantially compared to the amounts from the comparable periods two years ago. We are starting to compare current amounts to two years ago because the most recent payments are way up when compared to the very depressed levels of a year ago, when major chunks of excise taxes were either administratively delayed (alcohol and tobacco taxes), not assessed from April through December (airline taxes), or, in the case of highway taxes, because people weren’t driving nearly as much. After several months with total excise tax receipts down in the neighborhood of 20 percent compared to two years ago, the end-March payment was down by about 9 percent and the mid-April payment was down just 1 percent (see chart below). Excise tax receipts generally cover economic activity from two to four weeks earlier, suggesting the rebound started in early March. There can be anomalies–such as the strong end-January payment for which I have no explanation–so more data are needed to be sure that the recovery in excise tax revenues is real.

It’s hard to point to specific data yet to explain the pickup in excise taxes. For example, counts of people going through TSA are getting larger, but they are nowhere near two-year-ago levels. But the main such air travel taxes are levied when tickets are purchased, which can be well before the travel itself. It wouldn’t be surprising if people have lots of pent up demand for air travel and are busy booking trips now for future travel. Similarly, recent data from refiners on gasoline production–the taxes on which are the single largest source of excise tax revenue–have been improving, but are still down by maybe 5 percent to 10 percent in recent weeks compared to two-year ago amounts.

Note how difficult it is now to compare excise tax receipts to year-ago amounts (see chart below). Amounts in mid-April this year are up by about 78 percent compared to the depressed year-ago amounts, making for a very difficult assessment. Being up by 77.7 percent compared to a year ago, combined with being down by 44.1 percent in mid-April 2020 compared the amounts in mid-April 2019, mathematically yields receipts in mid-April of this year compared to mid-April 2019 being down by just under 1 percent. (1.777 times .559 equals .993, or a drop of 0.7 percent.) We can expect these large increases compared to year-ago amounts to continue given the much improved state of the pandemic and the economy. So, for a better comparison of current excises, I’d look back to 2019. (For a description of the ups and downs of excise tax revenues over the past year, see a previous post.)