Posted on July 21, 2021

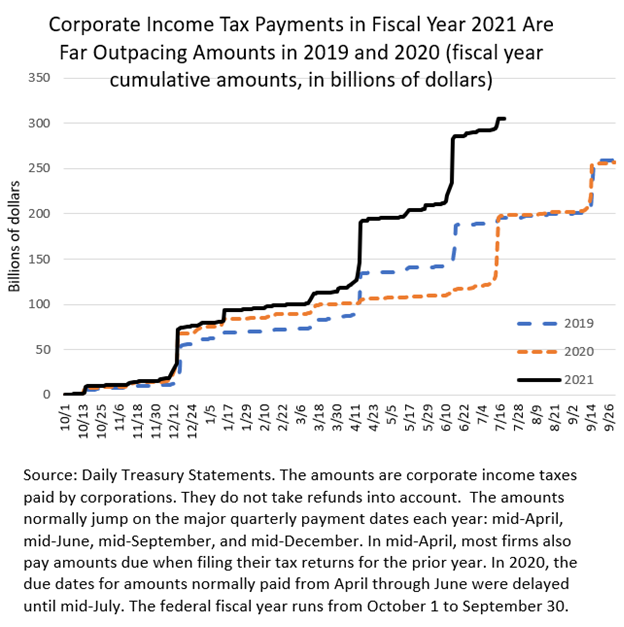

We’ve posted before about the surprisingly high amount of corporate income tax payments so far this year. With two-and-a-half months left in the fiscal year, amounts paid have already well exceeded amounts paid in all of 2019 and 2020 (see chart below). With the mid-July payment now in, payments this year to date–just over $300 billion–are running more than 50 percent ahead of both last year’s pace and that from 2019. With another major quarterly payment due in mid-September, corporate income tax payments in fiscal year 2021 are on track to be the largest since corporate income tax rates were reduced starting in 2018.

Until this week, we haven’t been able to compare corporate receipts this year to those paid in 2020, because the payment due dates for taxes owed between April and June 2020 were delayed until mid-July of that year. As a result, the mid-July payment last year was very large. Now we can make an apples-to-apples comparison of amounts paid so far this year to 2020 amounts.

Not only is the strength in corporate tax receipts so far in 2021 a surprise, but so too was the lack of a substantial drop in tax payments in 2020. Usually in recessions corporate tax payments fall because profits fall; profits fall because income sources fall more than expenses–in part because firms don’t immediately lay off workers in anticipation of needing them again when the economy recovers. That normal pattern probably didn’t apply last year when the pandemic shut down major portions of the economy. It is possible that the major disruptions in 2020 significantly boosted the profits of some firms and cut the profits of others. Because only profitable firms pay taxes, that could have set the stage for overall payments not dropping as in a normal recession, because payments were propped up by the newly very profitable firms. But now the burst of tax payments so far in 2021 suggests that overall corporate profitability is probably very strong. It will take at least a couple of years until tax return data become available to help us understand the amount of taxable profits in 2020 and the mix between firms in a profitable versus unprofitable position.

And note that none of this takes corporate income tax refunds into account. Before 2018 firms with losses were allowed to get refunds of recent taxes paid, further reducing net payments of income taxes in recessions. The CARES Act, enacted in March 2020, allowed firms to temporarily carry 2020 losses back to again obtain refunds, and even applied retroactively to losses incurred in 2018 and 2019; but we still haven’t seen much increase in corporate income tax refunds. Some of that could be a delay in processing at the IRS, because many such refund requests must be done by paper filing. As has been well documented, the IRS processing of paper filings has suffered greatly as a result of the pandemic.