Posted on May 8, 2020

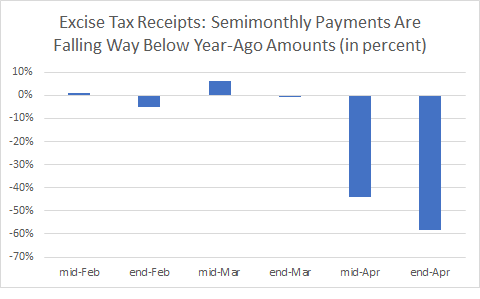

- Excise tax receipts were down about 58 percent in the latest semimonthly payment period at the end of April (compared to the same period a year ago).

- Declines were due to legislation suspending taxes (aviation taxes, which were going to be very low anyway); administrative relief allowing delays in paying taxes (alcohol and tobacco taxes); and declines in underlying activity (gasoline taxes).

Excise taxes, a small source of federal revenue, are dropping sharply, for the latest payment period down by 58 percent (compared to the same period a year ago, see chart below). The reasons for the decline in recent weeks mirror those explaining recent declines in overall revenues: legislated tax reductions, administratively-allowed payment delays, and declines in economic activity.

Excise taxes, which account for about 3 percent of total federal revenues, consist of more than 50 separate levies, but most all of the revenue comes from four sets of taxes: motor fuel and other highway-related taxes (almost half of total excise receipts); passenger ticket and other aviation taxes (about 20 percent); and alcohol and tobacco taxes (each a little over 10 percent, or about 25 percent combined). (I’m ignoring certain health-related taxes that have recently been repealed.)

Excise tax revenues have dropped sharply in recent weeks. Excise taxes are generally collected twice per month, once in the middle of the month and then again at the end of the month, for activity occurring roughly two to four weeks prior. (There are actually two payment deadlines, two or three days apart, for each semimonthly payment, depending on the type of excise tax.) It wasn’t until the mid-April payment, representing activity for the second half of March, that revenues first dropped sharply, by over 40 percent on a year-over-year basis (again, see the chart). The drop became even larger, 58 percent, for the payments made last week for activity in the first half of April. At this point, only overall excise tax revenue is known; the amounts for specific excise taxes are known only with a lag of several months.

Although we don’t have data on the recent collections of different types of excise taxes, it isn’t hard to see how the latest overall payment could be down by almost 60 percent. First, the CARES Act, enacted in late March, suspended nearly all aviation taxes for the rest of the calendar year, and there wasn’t going to be much collected in the near term anyway; given that those taxes account for about 20 percent of total excise revenue, that’s a decline in total excises of about 20 percent right there. Then the IRS provided relief to alcohol and tobacco producers, allowing a three-month delay in remitting taxes that would otherwise have been paid through June; that’s a decline of another 25 percent of total excises. Then there are motor fuel and other highway-related taxes. People nationally clearly aren’t driving anywhere near as much as before the stay-at-home orders, and thus refiners (who actually pay the tax) are producing much less fuel, by my read of the data about 25 percent less gasoline. Diesel fuel, used largely by trucks, isn’t affected nearly as much, but falling use of gasoline alone (which accounts for almost two-thirds of total highway taxes) would account for a decline of 5 to 10 percent in total excises.

The sources of the drop in excises reminds me of the sources of the drop in overall revenues. Some of the reduction in excise taxes is from payment delays (alcohol and tobacco); some is from a tax cut through the end of the year with very little activity for now anyway (aviation); and some is pure lost activity (gasoline). For revenues as a whole, legislation has provided various types of tax relief for businesses, as well as tax rebates for individuals (although it looks like those are going to be classified completely as outlays, with no part representing revenue reductions, in the federal budget, according to the Congressional Budget Office–though the effect on the federal deficit is the same regardless of the classification). In addition, the IRS has delayed the April 15 due date for personal tax returns until July 15, and that same day is now the due date for the first and second quarterly estimated payments of income taxes by individuals and businesses. And then the major increase in unemployment is causing withholding for income and payroll taxes to fall, with some legislated delays (enacted in the CARES Act) in remitting certain payroll taxes added on top of that.