Posted on June 2, 2021

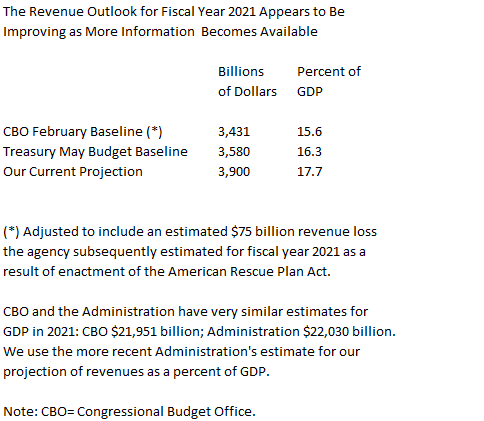

Two weeks ago we posted that federal revenues were growing quite quickly in recent months considering the effects of the recession, and it is becoming only more clear that such is the case. I am much more bullish on revenues for fiscal year 2021 than both the Administration, which just issued its budget last week, and the Congressional Budget Office (CBO), which last published its baseline projections back in February but is presumably getting busy on its normal summer update. With four months still to go in the fiscal year, and armed with knowledge of tax collections through May, I extrapolate that revenues for fiscal year 2021 could total about $3.9 trillion, assuming no changes to tax law before fiscal year’s end on September 30. That amount would be almost 13 percent higher than revenues in 2019 and 14 percent higher than last year. That extrapolated amount for 2021 is substantially higher than the $3.58 trillion that the Treasury Department just projected for 2021 under current law as a part of the President’s budget , and even higher than CBO’s projection of $3.43 trillion that I calculate by taking its February baseline projection of $3.506 trillion and subtracting the $75 billion revenue loss that the agency estimated would result in 2021 from the subsequently-enacted American Rescue Plan Act of 2021 (see table below).

So, based on my extrapolation, I project over $300 billion more in revenues than Treasury and even more compared to the much older CBO estimates, with the difference mostly from higher individual income and payroll taxes. That’s a lot of money with only 4 months to go in the fiscal year. Unless I’m missing something big in my projections–and yes, I’ve tried to account for a big backlog of tax return processing at the IRS that could boost refunds in coming months–the difference most likely results from me having more current information, especially the strong amount of payments made with 2020 individual income tax returns that were due to the IRS by the middle of last month. CBO’s projections were probably largely put together in December, and much can change in the meantime, and the Treasury Department presumably locked its projections well before the May tax collections started arriving.