Posted on October 3, 2022

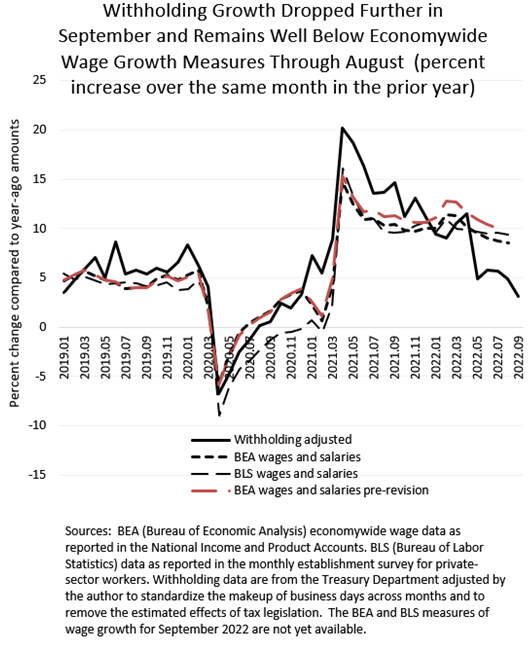

We measure that growth of federal tax withholding–the amount of federal income and payroll taxes withheld from workers’ paychecks and remitted to the U.S. Treasury Department–declined further in September, continuing a general move down in growth that began in May . We estimate that tax withholding grew by 3.1 percent in September (compared to the amounts from September of a year ago, measuring so-called year-over-year growth), a decline from the 4.9 percent year-over-year growth recorded in August (see chart below). The recent growth represents a significant drop from the 9 percent to 12 percent year-over-year growth recorded from January to April. Withholding tends to move with overall wages and salaries in the economy, but the recent amount of withholding growth is much lower than recent growth in wages as measured by the Bureau of Economic Analysis (BEA) in its National Income and Product Accounts and by the Bureau of Labor Statistics (BLS) in its monthly establishment survey of private-sector employers released on a Friday near the beginning of of each month. (The next BLS release, measuring different parts of the labor market in September, is scheduled for Friday of this week.) Note that our measure of growth in tax withholding is constructed by taking actual amounts of withholding as reported daily by the Treasury Department and then removing both the estimated effects of tax law changes (currently a small adjustment) and the estimated effects from different months having a different makeup of business days (see our methodology for more details).

Although withholding growth tends to move with wage and salary growth, they do not always move in lock-step. The economywide wage measures are subject to revision, sometimes significant revisions, and movements in average tax rates, such as from changes in the income distribution, can cause deviations between measured withholding growth and economywide wage growth. We were quoted in articles last week in Investor’s Business Daily and Politico about movements in recent withholding and the general distribution of income as evidenced by 2021 tax data.

The BEA measure of economywide wage growth, which is currently available through August, is especially subject to revision as better data become available. Indeed, late last week BEA released its annual revision of the GDP accounts, and its measure of economywide wage growth (on a year-over-year basis) was revised down by about 1.5 percentage points for recent months. (In the chart below, the dashed red line represents BEA’s measure before the revisions, and the dotted black line represents BEA’s latest, post-revision estimates). Even with the downward revision to BEA’s measure of wage growth, withholding growth remains well below BEA’s latest measure. BEA’s measure is subject to further revisions when data from the Quarterly Census of Employment and Wages become available in the future.

It is also quite possible that average tax rates in the economy are dropping because of shifts in the amount of earnings of higher- versus lower-wage individuals. There is evidence from different surveys that lower-income workers, who face lower income tax rates, have seen stronger growth in wages in recent months than have higher-income workers. For example, real-time data compiled by economists Thomas Blanchet, Emmanuel Saez, and Gabriel Zucman of the University of California, Berkeley, suggest that income of the bottom half of the income distribution has risen significantly more quickly than that of the top half of distribution since about the spring of 2021, roughly making up for relative losses through the worst of the pandemic. In addition, the BLS establishment survey suggests that production and nonsupervisory workers, who generally are paid less than all private-sector employees, have recorded relatively faster wage growth in recent months. Despite the evidence suggesting that wage distributional shifts have caused average tax rates to decline in recent months, the amount of the shift is probably not large enough to explain the full amount of the deviation between recent withholding and economywide wage growth measures.