Posted on November 2, 2022

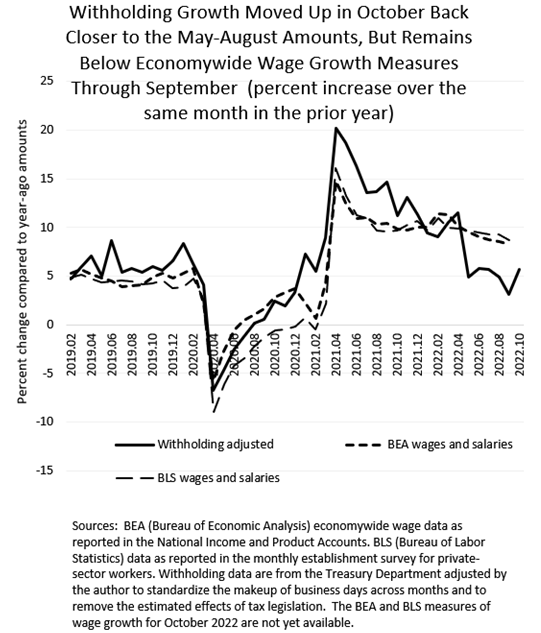

We estimate that growth in federal tax withholding–amounts of federal income and payroll taxes withheld from workers’ paychecks and remitted by employers to the U.S. Treasury–moved up in October, registering 5.7 percent growth (compared to amounts from October of a year ago, measuring so-called year-over-year growth). Withholding growth returned close to the growth measured from May through August, when it averaged 5.3 percent and reached 5.7 percent to 5.8 percent in June and July (see chart below). It now looks possible that the reduction in growth in September–to about 3 percent–may have been a measurement anomaly or an otherwise temporary move down. (For a description of how we measure withholding growth, which removes the estimated effects of tax law changes and standardizes the makeup of business days across months, see our methodology.)

Although withholding tends to move with overall wages in the economy, withholding growth in recent months has been significantly below wage growth as measured by the Bureau of Economic Analysis (BEA) in its National Income and Product Accounts, and by the Bureau of Labor Statistics (BLS) in its monthly establishment survey of private-sector employers (again, see the chart below). The measures of economywide wages and withholding can deviate for several reasons, but it takes months or longer for data to become available to help us understand the sources of the deviations. The BEA measure, which is more comprehensive and uses better underlying data sources than the BLS measure, is subject to significant revision, so it is possible that wage growth measured by BEA will eventually be revised down and will line up better with the growth in withholding. However, different growth in wages between higher- and lower-income workers can cause withholding growth to be either larger or smaller than wage growth. For example, there is evidence that in recent months the wages of lower-wage workers, who face the lowest overall tax rates, have been rising faster than those of higher-income workers, which would reduce overall withholding growth relative to wage growth.

We’ll be watching withholding closely this month to see if its growth remains near October’s amount (or even moves above it) or if it moves back down toward the low point registered in September. After November, we’ll be entering the December-January period when it is always harder to interpret withholding movements as a result of year-end bonuses and, in addition this year, the remittance of amounts that were allowed to be deferred by legislation enacted in 2020.