Posted on April 3, 2023

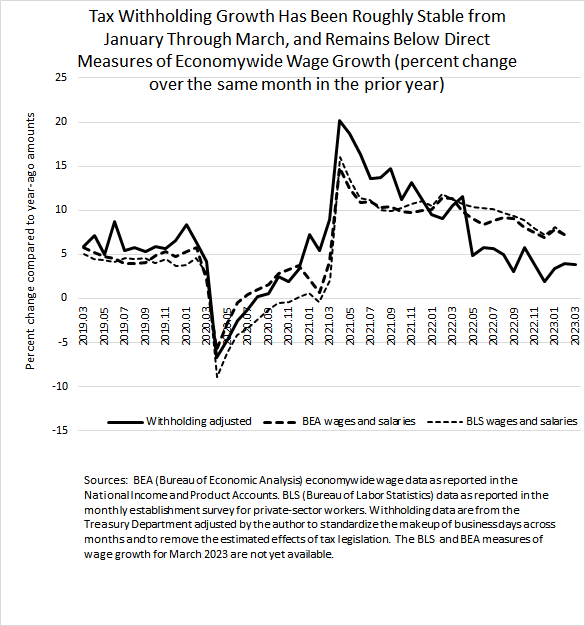

We estimate that growth in federal tax withholding–the amount of income and payroll taxes withheld from employees’ paychecks and remitted daily to the U.S. Treasury Department–grew by 3.8 percent in March (compared to the amounts from March of a year ago). That is just about the same as the 3.9 percent growth recorded in February (see the chart below). Withholding growth has been in the range of 2 percent to 6 percent since May of last year. Growth temporarily dipped in December to 2 percent, presumably because of weak year-end bonuses in the financial and real estate industries. Otherwise, withholding growth in each month since November has been in the rather narrow range of 3.4 percent to 3.9 percent. Note that our measure adjusts the actual amounts of daily withholding remittances to remove the estimated effects of tax law changes (with no such adjustments needed since November) and to standardize the calendar across months.

Although the measure of withholding growth normally tracks economywide wage growth fairly closely, the relationship has not been as close as is typical since the pandemic hit (again, see the chart below). Over the past year, withholding growth has lagged significantly behind growth in economywide wages as measured by both the Bureau of Economic Analysis (in its monthly GDP report) and the Bureau of Labor Statistics (in its monthly establishment report of private-sector workers). Two possible explanations seem most plausible. First, it is quite possible that average tax rates have fallen, which would be consistent with recent wage growth being greater for lower-wage-earning workers, who face the lower tax rates. That explanation is buttressed by some data, such as that compiled by economists Blanchet, Saez, and Zucman, that suggest that wages of lower-wage-earning workers overall have been growing relatively faster over the past year after being hit especially hard during the worst of the pandemic in 2020 and 2021. Second, the economywide wage data from the Bureau of Economic Analysis, which is more comprehensive than the survey-based data from the Bureau of Labor Statistics, may be revised in the future to more closely align with movements in withholding. In the past, some deviations between wage and withholding growth have been revised away in that manner.