Posted on April 30, 2025

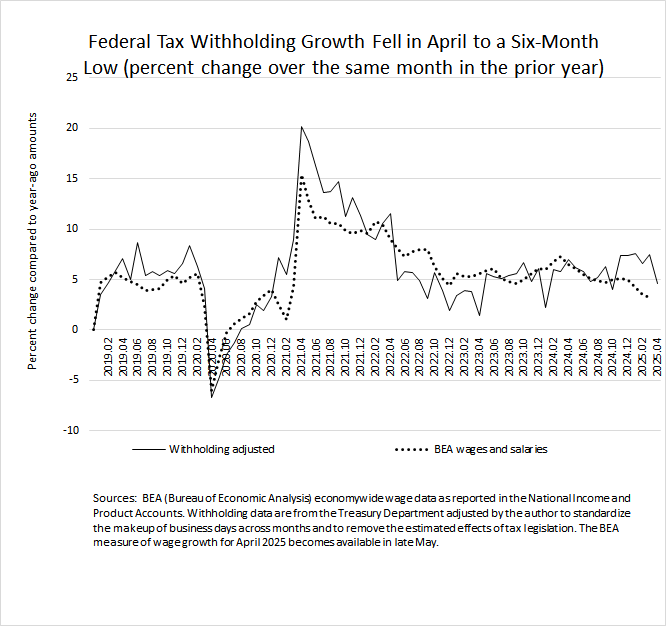

With the IRS’s counting of payments with income tax return filings still in the final stages, we turn our attention to federal income and payroll tax withholding. We estimate that year-over-year growth in such tax withholding slowed significantly in April, to 4.6 percent from an average of 7.3 percent over the past five months (see the chart below). (Year-over-year growth compares the amounts in this year’s month or months to those in the same period of a year ago.) The last time withholding growth was this low in a month was in October 2024, and we believe that was in part from the effects of hurricanes. Before that, we have to go back more than a year for such a low growth measure. Withholding is a noisy measure, however, and one month does not make a trend. Nonetheless, because withholding consists of income and payroll taxes held back from employees’ paychecks and remitted by the firms as soon as the next day to the U.S. Treasury, the amounts loosely track economywide wages and salaries (especially after economywide wage and salary measures, such as from the National Income and Product Accounts, are revised). Thus, noise and all, tax withholding provides a near contemporaneous reading on a major part of the U.S. economy. We will see if the withholding slowdown in April corresponds to a weak employment report for April from the Bureau of Labor Statistics, to be released on Friday morning of this week.