Posted on Tuesday April 30, 2024

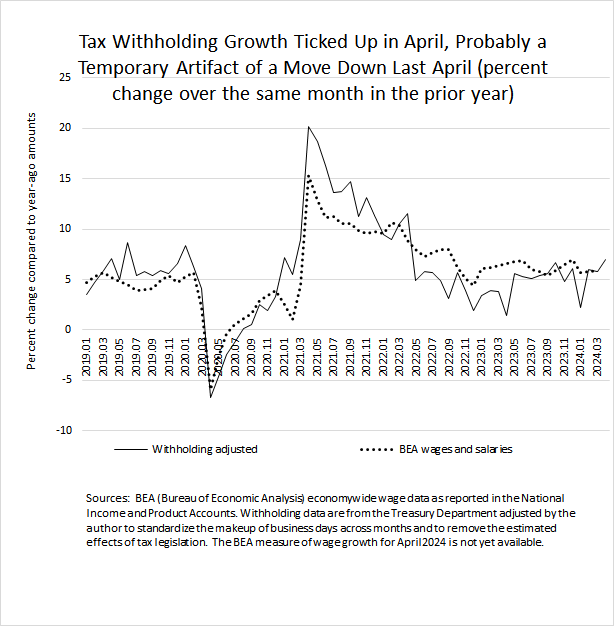

Federal tax withholding–the combined amount of income and payroll taxes withheld from workers’ paychecks and remitted daily by employers to the U.S. Treasury–increased by an estimated 7.0 percent in April (compared to the amount in April 2023). That is a tick upwards from growth in recent months, to the high end of the 5 percent to 7 percent growth recorded in each month since May 2023, with the exception of a dip in January 2024 (again, comparing all amounts to those from the same month of the prior year, see the chart below). The tick up in April is probably an artifact of a temporary tick downwards in April of a year ago. We don’t know what caused the downward move of a year ago. We will see if growth in May returns closer to the middle of the range of the past year.

Withholding growth tends to track economywide wage and salary growth, with the withholding measure available more quickly. At the end of May, the Bureau of Economic Analysis will report on April wage growth, and a less comprehensive measure will be included in the employment report for April to be released on Friday of this week by the Bureau of Labor Statistics. We don’t expect the measures of economywide wage growth to tick up in April like withholding, because the artifact of temporarily weak withholding in April 2023 did not also occur in economywide wages.