Posted on April 10, 2020

- The filing and processing of personal tax returns has slowed markedly in the past couple of weeks. That is an expected result of the nationwide efforts to contain the novel coronavirus and the IRS extension of the tax filing and associated payment deadline to July 15.

- But there are still probably more than 25 million tax refunds totaling more than $60 billion waiting to be claimed upon filing, and those taxpayers may need the refunds now more than ever.

- If you haven’t filed yet and can, and expect a refund, there’s probably no reason to wait. However, filing now may be easier said than done.

The IRS yesterday released its weekly data on processing of personal income tax refunds, and not surprisingly the pace of activity has slowed markedly. People have other things on their minds than doing their taxes and face other challenges in getting their returns prepared. And, in any event, the federal tax deadline has been delayed for three months until July 15 as a result of the public health emergency.

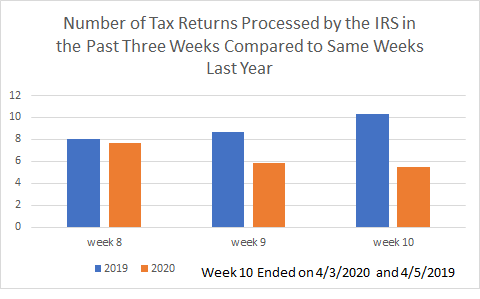

In the past two reporting weeks for this filing season (so March 23-27, week 9 of the season, and March 30-April 3, week 10), the IRS processed 11.4 million returns, compared to 19.0 million in the same period last year, a drop of 40 percent (see chart above). That big drop is partly because the IRS has received fewer returns. To a lesser extent the decline is because the IRS has processed a lower share of returns received–understandable given the difficulties processing returns with so many employees working remotely and with the agency having significant new responsibilities to implement aspects of the recently enacted CARE Act.

There are still a lot of refunds for taxpayers to receive in the current filing season, and those refunds are needed by many taxpayers now more than ever. Last year by the end of the normal disbursement of refunds in May, about 102 million refunds were issued totaling $277 billion. Through the entire filing season so far this year, the IRS has sent out 74 million refunds totaling $213 billion. That means that there are probably over 25 million refunds and, if the total dollar amount of refunds is at least as large as last year, more than $60 billion still to go to taxpayers this year when their returns are filed and processed.

Unfortunately, as with many things in the novel coronavirus environment, filing and getting those refunds may be easier said than done. Many people utilize volunteer tax preparation services that have shut down operations. Stay-at-home orders have presumably kept many people from utilizing for-pay preparation services, even those that are still open for business. People may have other things to worry more about than filing their taxes. But if you haven’t filed yet and can, and you expect a refund, there’s probably no reason to wait. And is it even possible that, for a change, doing one’s taxes could be a helpful distraction?