Posted on March 5, 2024

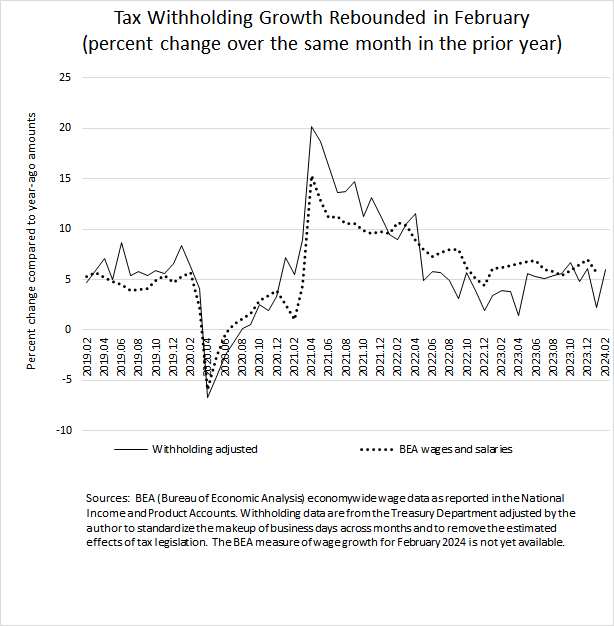

Federal tax withholding–the amount of income and payroll taxes withheld from workers’ paychecks and remitted daily to the U.S. Treasury Department–rebounded in February after a one-month dip (see the chart below). Specifically, we estimate that withholding grew by 6.0 percent in February (compared to the amount from February 2023), in line with the amount recorded from May to December 2023, when it grew by between 5 percent and 7 percent each month (again, comparing the amounts of withholding to those from the same month in the prior year). Growth temporarily declined to 2.3 percent growth in January 2024; withholding in January is hard to interpret because it is affected by year-end bonuses and two holidays. It appears that the withholding dip in January was temporary. Those growth figures all adjust the amount of withholding to standardize the makeup of business days across months (which can affect the reported amounts significantly) and to remove the estimated effects of tax law changes (with no adjustments currently needed).

Withholding moves with economywide wages and salaries (again, see the chart below). Thus, the February withholding data suggest that overall wages are continuing to grow at a significant pace.