Posted on April 2, 2024

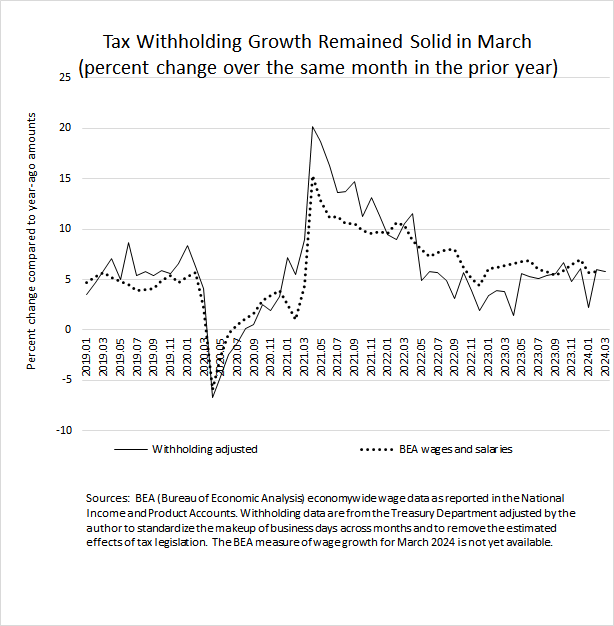

Federal tax withholding–the combined amount of income and payroll taxes withheld from workers’ paychecks and remitted daily by employers to the U.S. Treasury–continued to increase at a solid, healthy pace in March. We estimate that economywide withholding grew by 5.8 percent in March (compared to the amount in March 2023), about the same as the 6.0 percent growth recorded in February and in line with the range of 5 percent to 7 percent recorded in each month since May 2023, with the exception of a dip this past January (again, comparing all amounts of withholding to those from the same month in the prior year, see the chart below). Those growth measures all adjust the amount of withholding to standardize the makeup of business days across months (which otherwise can affect the reported monthly amounts significantly), and the growth measures also remove the estimated effects of tax law changes (with no adjustment currently needed). There have been no needed adjustments to reflect tax law changes since December 2022, with the exception of one month, December 2023; unadjusted withholding fell substantially in that month (as we measure it on a 12-month growth basis) because amounts of withholding in December 2022 were significantly boosted by certain employer tax remittances that were allowed to be deferred until then by the CARES Act of 2020. Our estimates of withholding growth are adjusted to remove the effects of those deferred remittances.

We expect that economywide wages and salaries are also continuing to grow at a significant pace, because they tend to move with overall tax withholding (again, see the chart below). That is not a surprise given that an employee’s tax withholding is based in large part on the amount of their wages and salaries. Withholding is also based on other factors, such as decisions that workers make about how much income tax to have withheld; legislative changes in tax rates and other parameters of the tax system (effects that we attempt to remove from our measure of withholding growth); changes in the distribution of wages between higher-income workers (who face the highest income tax rates) and other workers; and increases in workers’ pay that is faster than inflation, which pushes a higher share of income into higher tax brackets (with the reverse effect for pay that grows slower than inflation). The measure of economywide wage and salary growth in March from the Bureau of Labor Statistics becomes available on Friday of this week with the release of the employment report for the month, and the more comprehensive measure of wages and salaries from the Bureau of Economic Analysis becomes available in late April, although it is subject to much revision.