Posted on August 1, 2024

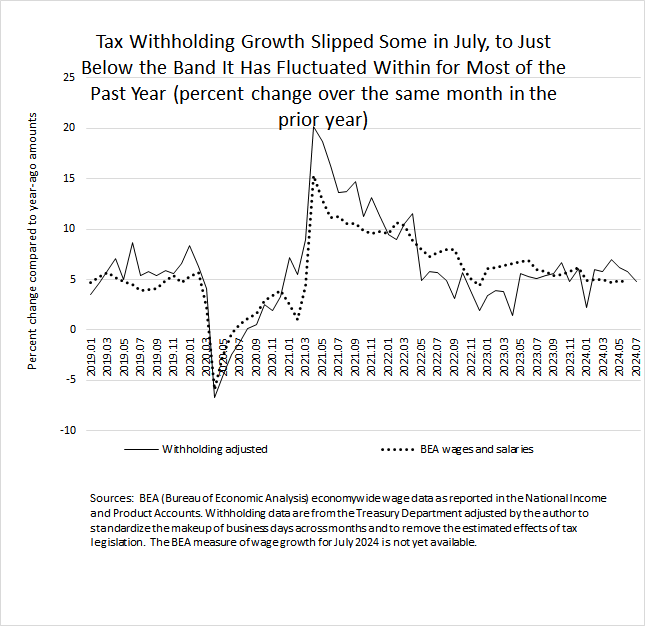

Growth in federal tax withholding–the combined amount of income and payroll taxes withheld from workers’ paychecks and remitted daily to the U.S. Treasury–slipped some in July. Based on data released daily by the U.S. Treasury Department, we estimate that the amount of withholding in July was 4.8 percent above the amount from July of a year ago (so-called year-over-year growth). That is slightly below the band of 5 percent to 7 percent year-over-year growth that we have measured in most months since May 2023 (see chart below). We measured year-over-year growth at 6.2 percent in May and 5.8 percent in June, near the middle of the band. In constructing our growth measures, we adjust the reported amount of withholding in two ways: standardizing the makeup of business days across months (which otherwise can affect the reported amounts and growth rates significantly); and removing the estimated effects of tax law changes (with no such adjustment currently needed).

Because withholding on our adjusted basis moves largely with overall wages and salaries in the economy, we expect that wages and salaries are continuing to grow at a relatively solid rate, but perhaps less than in recent months (again, see the chart below). The first government read on wage growth in July will be available in the employment report for the month to be released by the Bureau of Labor Statistics (BLS) tomorrow, Friday, August 2. We will see if the slower withholding growth corresponds to slower wage and salary growth, and perhaps employment growth, as measured by BLS. The more comprehensive measure of overall wages for July will be released by the Bureau of Economic Analysis late this month (in the GDP report), with the data subject to significant revision.