Posted on June 3, 2025

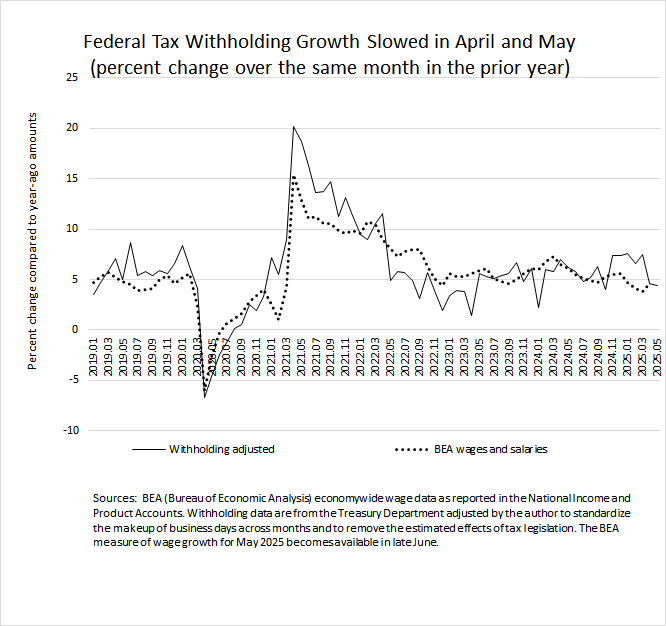

For the second consecutive month in May, U.S. federal tax withholding grew much more slowly than its monthly growth from November through March, and even a bit more slowly than in most months from mid-2023 to late 2024. Specifically, we estimate that federal tax withholding–the combined amount of income and payroll taxes withheld from workers’ paychecks and remitted by firms as quickly as the next day to the U.S. Treasury Department–grew by 4.4 percent in May compared to the amount of withholding in May 2024 (see the chart below). That so-called year-over-year growth was about the same as the 4.6 percent growth recorded in April, and we have not observed growth below 5 percent for two consecutive months in about two years. Although withholding growth has slowed, it has not slowed anywhere near enough to signal that the overall economy is in recession.

Because economywide federal tax withholding moves largely with overall wages and salaries in the U.S. economy–barring tax law changes or certain other events such as natural disasters–we expect that wage and salary growth has slowed in the past two months. The most comprehensive estimate of economywide wages and salaries that is available relatively quickly comes from the National Income and Product Accounts (NIPAs, which include Gross Domestic Product and its many components). That NIPA measure of wages and salaries, which is available about three or four weeks after the end of each month, is subject to much revision in subsequent months as more complete data are compiled. Over the past half year until last month, withholding growth exceeded NIPA wage growth by significant amounts (again see the chart below). In the past, such deviations have often been reduced by subsequent revisions to the NIPA wage data. In fact, NIPA wages and salaries were just revised up for the fourth quarter of 2024 and first quarter of 2025, narrowing the wedge somewhat between its growth and tax withholding growth. We expect that NIPA wages will be further revised up for the first quarter of 2025 in the coming months. We believe that financial sector year-end bonuses grew rapidly this past winter, and the initial wage and salary estimates incorporated into the NIPAs do not include movements in such bonuses. The revised data in coming months should capture those effects, and we will see if that significantly raises NIPA wage and salary growth for the first quarter to be at least closer to withholding growth.