Posted on March 4, 2025

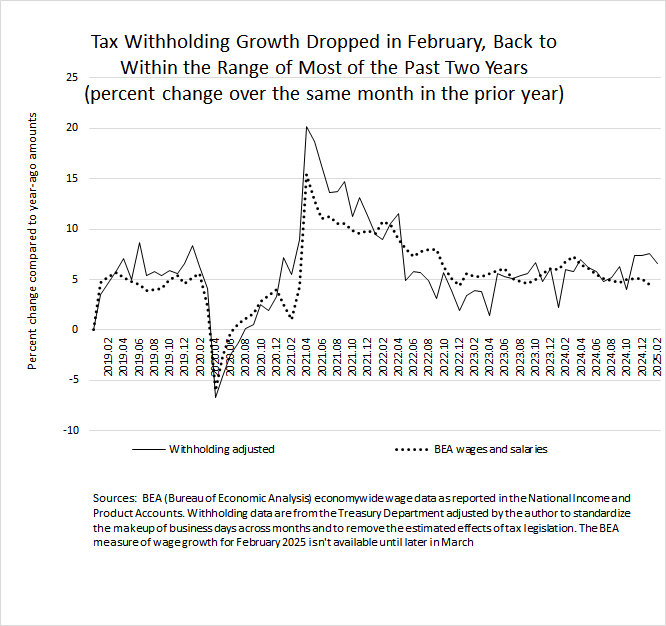

We estimate that growth in federal tax withholding–the combined amount of income and payroll taxes withheld from employees’ paychecks and remitted by firms as quickly as the next day to the U.S. Treasury Department–slowed in February. Based on data released daily by the U.S. Treasury, we estimate that economywide withholding in February was 6.6 percent above the amount from February of a year ago. That is about a percentage point lower than the growth in December and January, which we believe was boosted by substantial increases in year-end bonuses on Wall Street and beyond. The withholding growth in February is back within the range of 5 percent to 7 percent that withholding has grown over most of the past two years (see the chart below).

Because economywide federal tax withholding moves largely with overall wages and salaries in the U.S. economy–barring tax law changes or certain other events–we expect that wage and salary growth slowed in February. Preliminary data from the Bureau of Economic Analysis (BEA) in its GDP reports, however, suggest that wage and salary growth did not pick up in the December-January period (again, see the chart below). (The BEA data release for February will be available late the month.) Those data from BEA are subject to substantial revision, so we will see in coming months if those data for December and January are revised upwards to be more consistent with the withholding data.